“You’re slogging your way through an uncertain system. Outcomes and decisions are loosely linked, and there’s so much hidden information.” Annie Duke was talking about poker, but this quote is just as apt for the game of startups.

No matter if you’re on the founder’s or investor’s side of the table, startups look a lot like poker. They both involve big gambles, the kind where it’s unclear whether you’ll end up with a winning hand, or a “bad beat story” because the cards just didn’t go your way. There’s also a series of small decisions that need to be made at a lightning-fast pace — and a need to keep close tabs on your competitors, while not getting knocked off your own game. And if you’re forced to fold, you’re left to wonder if it was doomed from the outset, or if poor execution and unforeseen forces played a role.

Uncertainty swirls whenever luck plays a big hand in the outcome. And when there is so much information players don't (and can't possibly hope to) know, people often resort to relying on “track records,” “gut feelings,” and “instincts.” Without a solid decision process in place, founders and poker players alike risk amplifying the cognitive biases that frustrate all of our decisions. One such bias is what Duke calls “resulting” — a human impulse to equate the quality of a decision with the quality of its outcome. “I have yet to come across someone who doesn’t identify their best and worst results rather than their best and worst decisions,” she wrote in her bestselling book, “Thinking in Bets.”

In the context of poker, that might mean changing your strategy because you’ve been on a good streak, discounting the luck of the deal. Or overcorrecting when you’re riding a bad streak. In the world of startups, it might mean ascribing brilliance to founders and investors of a tiny startup that goes on to reach an impressive scale.

Resulting was one of many concepts that resonated with First Round partner and co-founder Josh Kopelman when he first read the book. Intrigued by how we could apply Duke’s frameworks to our own work of backing and advising founders who are just getting started, Kopelman got in touch. After a few weeks of a trial consulting engagement, a partnership quickly solidified. And so for the last few years, the First Round team has had the great fortune of working with Duke, who’s become our Special Partner for Decision-Making Science. (More on that story here.)

Duke’s resume isn’t standard fare in the startup world. She’s forged a fascinating career with several distinct chapters: first as a PhD student in cognitive science at the University of Pennsylvania, next as a professional poker player who made millions in tournament games, and now as a decision strategy consultant. (Not to mention that she’s a bestselling author and co-founder of The Alliance for Decision Education, a non-profit that aims to bolster decision-making skills in students.)

While it’s not a typical move for a venture fund to team up with an expert like Duke, for us here at First Round, the benefits have been multifold. On top of helping us reduce bias and bring even more rigor to our own investing process, Duke has also been a wonderful addition to the First Round community. Just as we have partners who’ve developed deep expertise in product strategy and go-to-market motions, it’s been an incredible boon to have Duke on deck to help founders hone their own decision-making chops.

What if decision-making were treated as a discipline at companies or a subject in grade school, one that we all constantly work on and strive to improve?

For the past couple of years, Duke has been sharing her advice with founders and angel investors in closed sessions for the First Round community, but given our focus on open-sourcing so others in the tech ecosystem can learn, we thought readers of The Review would be curious to see a few pages from her decision-making playbook, tailored specifically for the startup context.

In this exclusive interview, Duke offers a behind-the-scenes peek at her consulting work, sharing the very advice and frameworks that she walks founders in the First Round community through. We start by outlining the fundamental lessons that will sharpen a founder’s personal skills, as well as the company-wide decision hygiene that will steel a startup for scale. Duke gets incredibly tactical, offering decision-making pointers for everything from hiring and firing, to the “bet the company” decisions and the painful choice to wind things down. Let’s dive in.

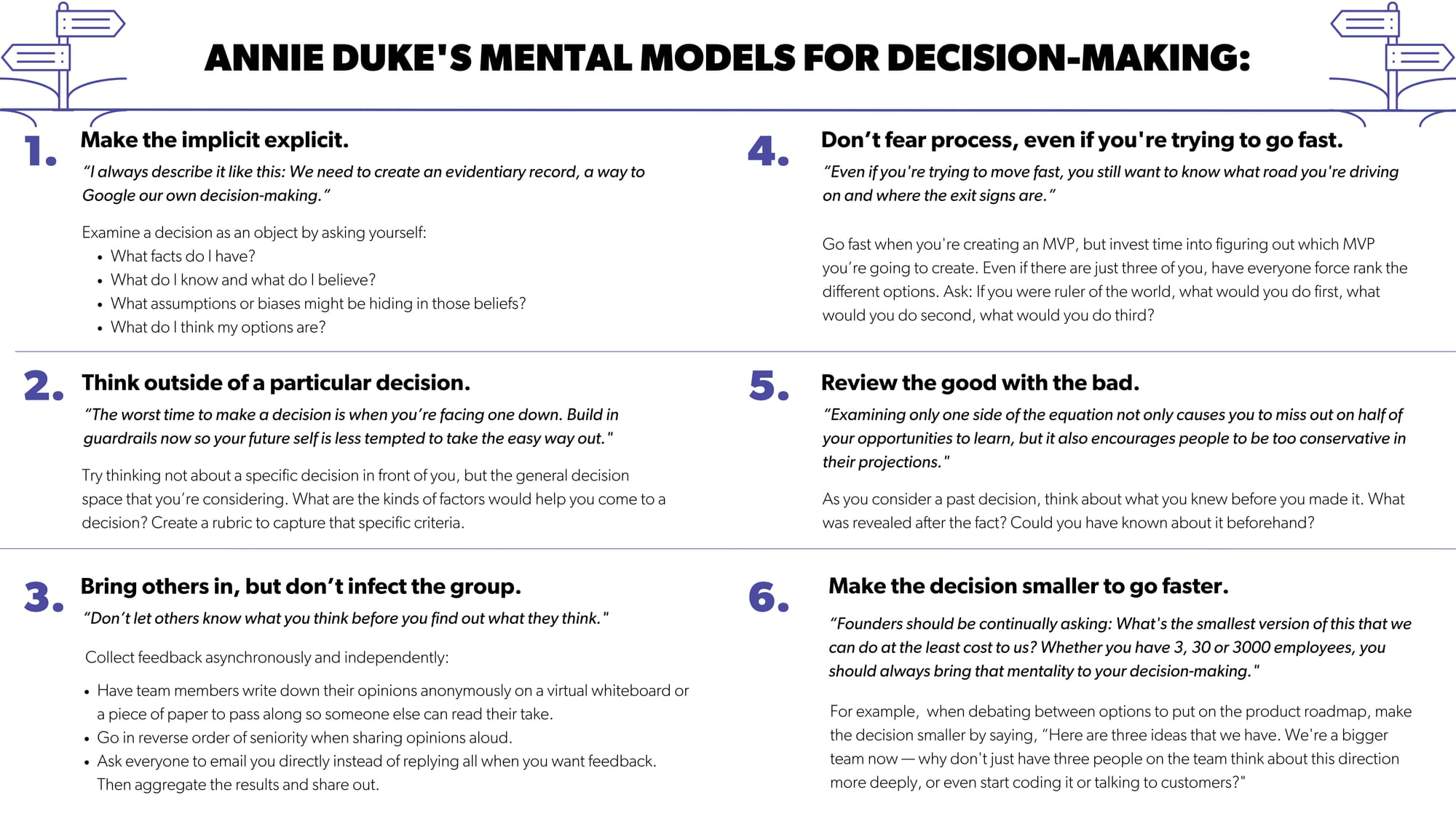

FOUNDATIONAL SKILLS: MENTAL MODELS FOR REDUCING BIAS

From the early-day choices of navigating the design partner process, to the later-stage judgments on introducing another product line and determining if it’s time to go public, the tempo never lets up and the decisions on a founder’s desk don’t get any easier.

In Duke’s eyes, it’s critical for founders to both sharpen their own decision-making skill-set, and maintain the hygiene and systems that allow the company to continue making high-quality decisions, even when scale takes over.

“When I first started consulting with founders and startup execs, I was surprised by just how often people are willing to go with their gut, or at least not make their process for entering into a decision explicit,” says Duke. “When you're dealing with the startup world, there’s a lot of uncertainty and that’s when people tend to go, ‘Well, I just go with my gut. I just know what a good decision is.’ But cognitive science shows us that our decisions are super noisy and tend to be very biased, so that’s not the right call.”

Duke breaks down these problem areas:

- Noise: “Different people have different judgments in identical situations, but also you'll have different judgments on different days. If a candidate comes in and interviews on one day, you may think about them differently than if they interview two weeks later. It could be an identical conversation, but you'd judge it differently depending on a ton of factors. Daniel Kahneman’s book, ‘Noise: A Flaw in Human Judgment,’ is a great read on this topic.”

- Bias: “We’re riddled with cognitive biases, predictable decision errors that frustrate the quality of our judgments. Any decision is a prediction of the future and those predictions can be pretty poor because of biases like overconfidence, confirmation, availability, hindsight, illusion of control,” says Duke. “We're also all handcuffed to our own personal experiences. Even though experience is necessary for learning, our own experiences can often interfere with learning. If we’ve developed subject matter expertise, or we've been doing something for a long time, we get trapped in those models of the world — and when new information comes in, we'll tend to interpret it to fit our model.”

Here’s the problem with relying on your gut: That's where all of that bias lives. It’s not your best decision-making tool.

Simple habits like asking yourself, “If I were wrong, why would that be?” can help you inculcate a more skeptical train of thought. But Duke advocates for a more wholesale approach to mitigating these forces and overhauling your decision-making chops.

“Taking a more systemic approach will not only improve your decision quality in the moment, it will also boost knowledge transfer among your team and get you higher quality feedback, more quickly, so you can get better faster,” she says.

Here are Duke’s foundational principles for improving your decision-making hygiene:

Mental model #1: Make the implicit explicit.

“On some level, you know that if you were asked to give a more specific answer than ‘My gut tells me this is the right move,’ it would be scary. The ‘right’ answer is kind of unknowable. In startups, where uncertainty is high and omniscience is impossible, decisions can feel like you’re making a random guess. But just because the answer's objectively unknowable, doesn't mean that you know nothing, nor does it mean that it’s not worthwhile to make what's going into your decision explicit,” Duke says.

To make great decisions, you need accountability, repeatability, and examinability. I always describe it like this: We need to create an evidentiary record, a way to Google our own decision-making.

“Think about how you can capture the knowledge that you're bringing into the decision so that it can be examined as an object. Ask yourself: What facts do I have? What do I know and what do I believe? What assumptions or biases might be hiding in those beliefs? What do I think my options are?”

Say you’re deciding whether it’s the right move to aggressively scale your sales team. There’s a laundry list of factors that go into that decision, such as: What’s the volume of leads you expect to have in your funnel over the next six months? What’s the probability of that occurring? What are your expectations around your burn rate and fundraising possibilities? How might that change depending on market conditions?

“If you go with your gut, you’re taking all of these things into account — you’re just leaving them implicit, which makes it hard to catch any errors or learn from your mistakes,” Duke says. “By making them explicit, you can discuss them with your team. You can hear other perspectives that might improve your own. And you can go back after the decision to see how good your judgment was at the time. All of this adds up to improve your decision quality.”

Regardless of whether you’ve made it explicit or not, you’ve already started to get yourself to a conclusion. That’s why traditional tools like a pros and cons list can be problematic — it’s just going to amplify the conclusion that you already want to arrive at.

Mental model #2: Think outside of a particular decision that you're facing.

“Try thinking not about a specific decision in front of you, but the general decision space that you’re considering. What are the kinds of factors that would help you come to a decision? Kahneman would call these mediating judgments — and thinking about them before you’re actually facing down the decision will help you reduce the noise and the bias,” says Duke.

The worst time to make a decision is when you’re facing one down.

For any of those factors, dig deeper into the detailed criteria you’d need to make that judgment. “It’s almost check-listing. With the specific criteria outlined in advance, you can't subconsciously ignore a good or bad signal — you have to rate every single one. Additionally, if you are recording your decision and your thinking, then you’ll know that your future self and others are going to come back and look at it.”

Take this common example: You’re running a hiring process that’s been something of a slog. You meet a candidate with incredible presence, one who stands out above the rest. “The charisma of the candidate will cause you to rate everything else more highly — even if that’s not a quality that’s required for the role,” says Duke. “But if you take the time to decide what attributes matter in advance, you’ll discipline the decision, reduce the capricious element, and help yourself to be a better judge in the future.”

Of course, creating a rubric has become a best practice when it comes to startup hiring. But in our experience, very few founders take Duke’s advice and extend this mental model to other important decisions, like entertaining acquisition offers or choosing to raise another round of funding.

If you can decide the things that you need to make judgments about in advance and then record those judgments for posterity, your future self will thank you.

Mental model #3: Bring others in, but don’t infect the group.

Getting the perspectives of others can be the antidote to the limitations of our own experiences and biases. “It’s great to have other people make the same judgments as you to uncover where there’s dispersion of opinion— but that only works if the judgments are independent. To achieve that independence, don’t let others know what you think before you find out what they think,” she says. “And in a group, there’s the added element of cross-influence. People are going to try to convince each other. There’s going to be contagion, and sometimes it can even become combative, which is bad for decision-making.”

That’s why it’s critical for founders to ensure that initial feedback is collected asynchronously and independently. “Get everyone to rate each attribute on a certain scale, like zero to seven. That way you can see everybody's opinion and pinpoint the places where opinions don’t align. I prefer to use ‘dispersion’ over the negative connotations of ‘disagree’ — it’s a more neutral way of talking about places where people’s opinions differ.”

But even simple changes can have a massive impact. For a more lightweight process or lower-impact decisions, there are several tactics to try out:

- Have team members write down their opinions anonymously on a virtual whiteboard. Or if in person, have them write it on a piece of paper to pass along so someone else can read their take.

- If folks on your team are sharing their own opinions aloud, go in reverse order of seniority.

- When sending an email asking for feedback on an idea, ask everyone to email you directly instead of replying all. Then aggregate the results and share out.

SETTING UP FOR SCALE: MENTAL MODELS FOR BOOSTING COMPANY-WIDE DECISION HYGIENE

But examining your own personal decision-making as a founder or within your executive team meetings isn’t enough. Thinking about your company’s systems is a crucial part of improving decision-making. Duke shares more on what good decision hygiene looks like at an early-stage startup, and how it needs to change once the company starts scaling.

Mental model #4: Don’t fear process, even if you're trying to go fast.

“The ways startups approach decision-making is the opposite of the ways large enterprises do — and neither of them are really getting it right,” says Duke.

We’re all familiar with the BigCo horror stories: layers of approval and decisions by committee. “This cements a status quo, a ‘this is the way we do things’ mentality. People start to develop career risk, and so they want approvals and coverage,” she says. “A startup has the opposite problem, which is that they don't have enough process in place.”

That can be an advantage, particularly when the cost of doing so is low and the decision is truly reversible. “Minimum viable products are a good example here — just do it fast and find out what the customer thinks, fix the bugs, iterate on the features. But the problem of figuring out which new product you’re going to develop in the first place? Now, that's another question,” says Duke. “For some decisions, the scrappy startup ‘Let’s just try it,’ mentality works great, but for others, you really need to step back and establish some regular process for triaging, especially when you have limited resources.”

Even though startups move fast, it’s easy to get sidetracked and sink time into the wrong things. “Go fast when you're creating an MVP, but invest time into figuring out which MVP you’re going to create. Take a beat to say, ‘Here are our options, here are the different things we can do.’ Even if there are just three of you, have everyone force rank them. Ask: If you were ruler of the world, what would you do first, what would you do second, what would you do third?” she says.

Even if you're trying to move fast, you still want to know what road you're driving on and where the exit signs are. There's a difference between going fast for the sake of it, and executing quickly while taking the time to directionally understand where you want to go.

Mental model #5: Review the good with the bad.

Another muscle to start bulking up? Getting into the habit of analyzing your previous decisions. “As you consider a past decision as a team, think about what you knew before you made it. What was revealed after the fact? Could you have known about it beforehand?” says Duke.

But importantly, don’t just do it in a blameless post-mortem setting — reviewing good outcomes is just as important. “We tend to only review decisions that are associated with bad outcomes, like missing a sales target by 10%. But when you exceed that same target by 10%, there’s no meeting, no post-mortem. Just congratulations all around,” she says.

“But missing and exceeding targets are both signals that you possibly overlooked something in your forecast. Examining only one side of the equation not only causes you to miss out on half of your opportunities to learn, but it also encourages people to be too conservative in their projections because they’re afraid of being grilled when they miss.”

If you like Annie Duke's advice, consider taking her Make Better Decisions course on Maven

Mental model #6: Make the decision smaller to go faster.

It’s a common sensation: As the team grows from 10 to 20 to 50, an unsettling feeling seeps in. Founders feel more removed — and more frustrated that the team is starting to move too slowly. “We're not as fast as we used to be,” becomes a common refrain.

“Many feel that introducing process or adhering to a decision-making system slows you down. But knowing when it’s okay to save time is part of a good decision process. This is a question of assessing the impact and the reversibility of the decision if you get it really wrong,” she says. “It's the difference between hiring an intern and hiring a C-level exec. A good framing is to ask yourself, ‘If I pick this option, what’s the cost of quitting?’ The lower the cost of changing course, the faster you can go.”

As an early-stage founder, this instinct might be reflexive, but as the company grows ever bigger, the more weighty decisions start to pile up. “The framing that’s helpful here is asking yourself: Is there a way for me to make this a smaller decision than the one I am considering? It’s about realizing that, in some sense, you do have control over how big the decision is.” says Duke.

Founders should be continually asking: What's the smallest version of this that we can do at the least cost to us? Whether you have 3, 30 or 3000 employees, you should always bring that mentality to your decision-making.

Take the product roadmap as an example. “There’s often a feeling that you have to get it perfect, that you have to select exactly the right strategy because it’s where you’ll be investing your precious resources. But instead could you say, ‘Here are three ideas that we have. We're a bigger team now — why don't just have three people on the team think about this direction more deeply, or even start coding it or talking to customers? That way we’ll have gotten more information to make a better decision.”

UNPACKING THE BIG-TICKET ITEMS: TACTICS & FRAMEWORKS FOR SPECIFIC DECISIONS FOUNDERS FACE

With those core concepts in place, Duke dives a layer deeper to give more context-specific advice around the big decision points founders encounter.

Customer discovery: How to figure out what to build and find signal in the noise of feedback

In working with design partners and running an early customer discovery process, there are plenty of stumbling blocks — like the challenge of trying to figure out exactly what you should build, the overwhelming (and conflicting) product opinions you collect, and the influence of your own bias as a builder, to name a few.

“When you’re considering different directions, think very clearly about the feedback that you're trying to get from the people who you're asking to help you,” says Duke. Unsurprisingly, she recommends getting opinions in advance and looking for areas of dispersion.

“You want to understand the acuteness of the problem you’re trying to solve. Get customers to rate that on a scale of one to seven, and ask them to give you a rationale for why the problem is so acute. Then you could ask them how well a certain feature would reduce the pain of the problem that they’re having, where a seven is amazing, a one wouldn't address it at all, and a three is pretty good,” Duke says.

Here’s why: “The last customer conversation you had will bias the next one. You’ll go in saying, ‘Well, what do you think of this direction? Because I was just talking to somebody and they thought…’ And now you haven't gotten their independent thoughts,” she says. “If you get their opinions in advance, you can see how much dispersion is there among your potential customers. And then you can focus on the areas where you know they disagree and start exploring where that difference of opinion is coming from. You want to cut through to the new and the different, quickly. I read an interesting paper that said when you're doing customer interviews, you should stop after you have an interview where less than 5% of the information is new.”

If you have free-form conversations with potential customers, you're going to learn less than if you start off by getting their opinions in advance.

Hiring: How to improve your accuracy

“On average, 50% of your hires are going to work out and 50% won't. But if you get more granular, a third of them are going to be awesome, a third will be fine, and a third are going to be terrible. And it’s not surprising that companies are so bad at it — it would be like if you got married to someone based on a first date and two friends telling you they thought the person was cool,” says Duke.

“In theory, everyone knows not to do that. But in practice, when there's pressure to meet your headcount quotas or get a new initiative off the ground, we do the near equivalent of this all the time. If you’re hiring an intern, where making a mistake doesn't have a big impact on your company, it’s not a big deal to go too fast. But when you’re going from 6 to 7 people, getting it wrong can be a disaster. That's where you get the most value out of slowing down.”

For Duke, improving the quality of our ability to hire comes down to doing a better job of capturing the qualities that actually are predictive of success in this job. “It sounds so simple, but it makes such a difference just knowing what it is that you're trying to bring onto your team, having people talk to the candidate and filling out a form ranking those features that you've decided in advance are important to you,” she says.

“Think very carefully about this for every position. List out 3-6 characteristics and figure out the mediating judgments that can help you break them down further. For example, if you’re hiring an executive and collaborative leadership is important, are they going to be a strong partner to the rest of the executive team? Are they going to be able to manage down as well as they manage up?” says Duke. “Outside of a candidate’s specific qualities, what challenges do we expect this person to address in both the short- and long-term? Do we see this person growing with the job? Can we imagine this person as a leader in the company going forward?"

Move faster than you’re comfortable with when you're trying to ship a product, but move more slowly when you're going from six employees to seven.

Interviewing for decision acumen:

Duke shares some of her favorite interview questions to ask candidates to probe their decision-making skills:

- How do you understand uncertainty? When you're thinking about a problem, how much data do you need to collect before you're willing to act?

- Can you give me an example of a decision you made where there was lots of disagreement? How did you actually manage to come to a decision, given that so many people disagreed with you?

She also recommends turning things around and questioning yourself as you narrow in on a top contender. “Imagine it’s a year from now and they’ve quit — why did that happen? Is there information you could find that would switch your choice to a different candidate or cause you to continue your search?” she says.

Firing: How to get better at it

Most founders understand this intellectually, but find the mantra of “hire slow, fire fast” to be incredibly difficult to implement. “Nobel laureate Richard Thaler captured this really well — we don't like to close an account in the losses. When we start down a certain path, that opens an account, similar to buying a stock. If you hire someone new, and they're working out, then that account goes up in value. If they're not, then it goes down,” she explains.

And as humans, we don’t like the implications of closing an account in the losses. “If I hire someone and then I fire them, then I have to just take the loss. But if I keep them on and say, ‘I can manage my way out of this and make them better,’ then maybe I can get out of this losing position. It's one thing to have a loss on paper, but actually selling the losing stock — or letting the person go — that is the moment it turns into a realized loss. It’s admitting you failed. ”

having failed

In Duke’s view, there are two ways founders can solve this:

Technique #1: Flip the framing.

“Ask yourself: What could I be doing with the money, equity, and time that I am putting into this person? If I free that up, what could I be using that for? That allows you to start recognizing the opportunity costs that you're incurring — separate and apart from the cost of having an employee who just happens not to be performing. It's costing you the opportunity to hire someone else who does meet your standards,” she says.

Technique #2: Pre-commit.

As ever, thinking things through in advance can bring clarity and resolve. “Ideally when you hire someone, you should say: What could I see in the future that would cause me to want to let this person go? Setting those criteria for yourself in advance is incredibly useful,” says Duke.

“Imagine it's a year from now, and you’re really unhappy with this hire — what were the early signals that this person wasn't going to work out? Write them down, and for each one, figure out if it’s a signal where you would fire, or a signal where you would manage it. And decide in advance how you would manage it,” she says.

“But in reality, almost no one does that at the outset. The good news, though, is that it’s never too late to start. The first time you have the, ‘Oh, I don't think this person is working out,’ feeling, you’re probably not going to let them go. That's human nature. But you can seize the opportunity to set benchmarks that the employee needs to hit to stay on. If you don't, you'll be faced with the same decision again soon enough — and you’ll rationalize it away yet again. Cast yourself into the future to stop repeating the error.”

Do that by asking:

- What do I need to see over the next X period of time for me to feel like I've regained confidence in this person?

- What are the benchmarks or KPIs that I think they need to hit?

- What do I need to see in terms of performance and level of effort?

“Share those with the employee and have an honest conversation that if they don’t meet these expectations in a certain period of time, you’ll have to let them go. That way if they don't meet that bar, you can actually let them go. It basically creates what's called a pre-commitment contract: You're committing in advance to certain actions in the future, which in the behavioral science world, is one of the best ways to improve decisions and outcomes,” Duke says.

When you're actually staring the decision down, you're not going to make a particularly good call. Build in guardrails now so your future self is less tempted to take the easy way out.

“Bet the company” decisions:

But there's a difference between adding a feature to a product roadmap and going after a new market, building a second product, or entertaining an acquisition offer.

“When it comes to deciding the direction of a company, what are the things you need to understand? For example, ‘Should we pivot?’ is essentially an expected value question. How's it going on the path we’re on, versus how might it go on the new path?” she says. Duke’s advice is to approach it as a brand-new decision. “What are the costs and benefits to changing direction, and what are the costs and benefits of sticking?”

When you're talking about switching directions, you're always going to be biased towards sticking. Try to approach it as a new decision. Ask yourself and others: Imagine we were starting the company today — what would we do?

“As much as you can, think through the structure of the decision in advance. What are the criteria that you need to be thinking about? What is the data that you need to gather? No matter what, it's not going to be two plus two equals four. You're never going to get that kind of precision on which way you should take the company. It's going to be what people's best judgments of those things are, so getting a diverse set of independent points of view is critical.”

Take the decision on whether or not to sell. “All along the way as you’re building, think, ‘What are the circumstances under which we would sell? What are the inputs that will help us make the decision?’ Maybe you need a CFO to figure that out. Maybe you can lean on your investor and board members. Send them an exercise like, ‘Imagine that we're fielding an offer and someone wants to buy us. What do you think the circumstances are under which we should do that? What does the offer need to look like?’” she says.

“Try to do that exercise when you're not fielding an offer. This is the kind of thing you can put on a cadence, because obviously it’s going to be a different question when you're pre-seed than when you're at Series E.”

Winding down: The art of knowing when to quit

This perhaps is the biggest area of difference between poker and startups. While poker is famously about knowing when to hold ‘em and when to fold ‘em, a just “grind it out” mentality still pervades the tech world. In fact, quitting is the topic of Duke’s forthcoming book.

Duke digs into the signs that founders should think about throwing in the towel (whether that’s shuttering a product line, or the bigger decision to sunset their beloved startup). “This is very similar to the question of when to fire an employee — at the point that you're starting to think, ‘Maybe this isn't going very well,’ you probably should have shut it down a while ago,” she says.

Here are three specific rationales founders need to let go of here:

“I know I can turn it around.”

“Maybe so, maybe not. It’s really important to apply that future casting technique and say, ‘What are the things that I need to see happen over the next month? What are the benchmarks that I need to be hitting over the next two months?’” she says.

“Imagine it's three months from now and you’ve realized that you definitely need to shut the company down — what were the signals that that was true? Or flip it around and imagine it's three months from now and all of a sudden things have started to go really well. That can help you get more clarity.”

“My investors will think less of me.”

“Many founders fall into the trap of thinking, ‘My investors are expecting me to just grind it down to the nub,’ or ‘If I quit, people are going to think I didn't have the grit.’ This is all about external validity, our fears about how others are going to judge us.”

Duke has a great story in her back pocket to help drive home the point: “For my new book I interviewed Dr. Ken Kamler. As a microsurgeon, he got into climbing and emergency medicine, serving as a doctor on expeditions to Everest. On one trek, there had been a lot of snow, so the going was very slow — he likened it to climbing in a bowl of sugar. And one of the most dangerous parts of the mountain is the Southeast Ridge. You have to descend it in daylight, which means you have to be able to get there and back before the sun goes down. And the team realized they were going too slowly,” she recounts.

“As they were debating what to do, Kamler says he was thinking to himself, ‘If I turn around at this point, all my friends are going to think I'm a wuss and that I failed.’ But the climbers all agreed they needed to turn around. And when he got home, Kamler reported that no one he knew reacted the way he expected. Everyone was like, ‘Whoa! That's amazing. I don't know if I could have turned around in that situation. You're a great decision-maker.’”

Something we all need to realize is that the things that we tell ourselves in our heads are generally to justify our own desire not to quit, as opposed to what other people will actually think of us.

“Similarly, investors aren't sad when you return capital to them — they'll probably invest in your next endeavor. You owe it to your investors to build something that has a high enough probability to win. But you also owe it to them to abandon something when the writing's on the wall.”

"I owe it to my employees”

“This goes back to how we don’t want to close an account in the losses — you're just using your employees as a way to say that. You've put your heart and soul into the matter, and you're worried that closing at a loss means having to admit failure,” says Duke.

“But from the employee's perspective, you're trapping them in a situation where they're probably working for equity and taking a hit on cash comp — and you've already realized that the equity is probably worth zero. What if you freed up their time to go to another job?”

We think "I don't want to let my employees down by shutting down my startup," but you're actually doing the opposite. You're letting them go to a company where they're going to find success.

If you’re interested in learning how these tactics apply to angel investing, consider applying for Angel Track, where Duke leads a session.