At their very core, founders are builders — it’s the gravitational pull that draws entrepreneurs to start a company from scratch. It’s the energy they get from building that sustains them when the nights are long, the to-do list is even longer and the coffee never seems strong enough.

But eventually, with an MVP in hand, founders must start to emerge from this building frenzy and turn their attention outward — and that’s where many folks get stuck.

By trade, founders don’t tend to come up through the go-to-market org — you’re much more likely to see a long list of product or engineering acolytes. Founders often hear selling and cringe, drumming up the famous “Coffee is for closers!” speech from "Glengarry Glen Ross." But designing a beautiful, dazzling product can only go so far without the right GTM playbook that drives customers to buy.

At First Round, we’ve partnered with hundreds of early-stage founding teams just embarking on their go-to-market journey, specifically on that especially bumpy first leg of 0 to $1M in ARR.

The truth is, there can be an air of mystery to sales at the earliest stages of a startup. Even founders who go on to build billion-dollar brands might look back on those early deals and recall “something just clicked” — which isn’t particularly helpful advice for the rest of us.

So about a year ago, we brought on someone to help demystify early startup sales, turning to a familiar face and hiring Emery Rosansky as our first-ever VP of GTM. We were originally introduced to Rosansky as a sales executive at Curalate, a company we invested in all the way back in 2012. She then stayed in the First Round family, taking on a new role at Augury, another company in our community.

We were wholly impressed with her chops and early-stage expertise and were thrilled to bring Rosansky into the fold. Over the course of the last year, she’s gotten even closer to founders, helping them carefully craft everything from buyer personas, pitch messaging, sales process and comp plans, to GTM hires, customer success playbooks, pilot structures and contract negotiations. Whether she’s riding along on a sales call, interviewing AE candidates, or hosting a weekly huddle to help close those early deals faster, she’s deep in the tactical weeds, working alongside founders as they tackle their GTM firsts.

“When you’re early, the typical advice is to not waste your time on process and structure. I agree that you don’t want to over-engineer, but so many founders forgo fundamental, simple processes — and they can really flounder because of that,” she says.

Set good GTM habits and processes in the early days of a startup — don’t wait until you’ve built out a whole sales org. Molding a mound of clay is infinitely easier than chipping away from a block of marble.

Of course, every startup comes with a long list of unique challenges on the path to product-market fit. But in these 1:1 sessions that Rosansky hosts with founders, a few common questions emerge over and over again, like, “How do I know if I’m any good at selling?” or “How can I know what's going on with my sales funnel?” just to name a few.

It prompted her to start writing a “Dear Abby”-style advice column, aptly named “Dear Emery,” which she shared internally with the First Round Network community. The regular column has been so well-received that we wanted to share some of her tailored advice with the wider startup community.

In this exclusive interview, Rosansky unpacks her best bits of guidance and tailor-made playbooks for the most pressing early GTM questions that have founders banging down her door for help: how to sketch out an ICP, score your sales calls, architect a pilot and forecast more accurately. Alongside her expert advice, Rosansky shares tactical templates that you can put to use right away.

FAQ #1: HOW DO I FIGURE OUT MY ICP?

As you start to sketch out your product in the very earliest days, you likely have a vague sense of who you’re building for. You’ve (hopefully) done some idea and customer validation, and have a rough sketch of the sort of company that might use your product and most viscerally feels the problem you’re trying to solve.

But as you start to approach the GTM process, this hazy sketch needs to get quite a bit crisper. Enter the ICP — a detailed description of the perfect customer (in the case of B2B, that means company) for your organization. Rosansky notes that in the early days, this might start out pretty broad, but as you gain a better understanding of your ICP, it could include criteria across half a dozen categories.

A well-articulated ICP can go a long way in allocating your limited time effectively by making sure you’re focusing on the customers most likely to buy. And yet, far too often, founders are keen to skip this important step, assuming they’ll just let customer pull guide them along, with the ICP sorting itself out eventually.

“Even when you’re early, it’s important to start to define your ICP so you can narrow your focus, learn and iterate faster, and optimize for quality leads: the companies that are both prioritizing the problem you solve and will have the biggest impact from using your solution,” says Rosansky.

I warn founders all the time that the spray-and-pray method rarely works. Your messaging has to resonate with your audience or they won’t respond. The more clear the ICP, the more relevant you can make your messaging.

Even if the loosey-goosey approach is bringing in deals, you may not feel the ripple effects until later down the line, when it’s much harder to change course. “If you spray and pray, you end up with a bunch of mismatched customers that are hard to draw patterns from. The benefit of getting crisp with your ICP is that you can begin to own a specific use case or industry and use that as a beachhead to find and land lookalike customers,” she says.

The reality is that in the early days, you’re flying nearly blind with a small amount of data, so this initial ICP is not much more than an educated hypothesis. Here’s the question Rosansky poses to founders: “What are the signals that this customer is a perfect fit for your solution?”

To embark on answering this question, there are three ways to find signal:

- User Research: “User research is a great way to surface ideas around your ICP. Your goal is to discern the common threads between people who are most deeply suffering from the problem you’re trying to solve,” says Rosansky. “For example, one First Round company we were working with thought they were selling to CISOs at early- and growth-stage orgs, but realized through user research discussions that the people that acutely felt the pain were 2-3 levels below a CISO in an Enterprise org. This insight transformed their ICP focus.”

- Closed-Won Deal Analysis: You probably don’t have a ton of deals under your belt at this point, but even if you have just a couple customers, you can start looking for patterns. “The questions you want to answer are: a) What are the commonalities across all of our existing customers? b) What are the commonalities amongst our customers who had the fastest closing deals? and c) What are the commonalities amongst our customers who had the biggest deal sizes?”

- Hypotheses on Operational and Strategic Fit: “I would argue that this is the most important piece when it comes to nailing your ICP in the early stage. These are the best indicators of your early adopters, the folks for which your solution will be a high priority and a high impact for that company today.” Let’s sketch this out further with an example: “Say you sell an employee onboarding platform and one of your ‘high priority’ signals is that a company is doing a lot of hiring and that they’re hiring remotely. That means, instead of just using a standard ICP parameter like company size and targeting companies with more than 500 employees, you’d narrow your focus to go after companies with more than 20 open, remote roles on LinkedIn. That’s a sharper ICP.”

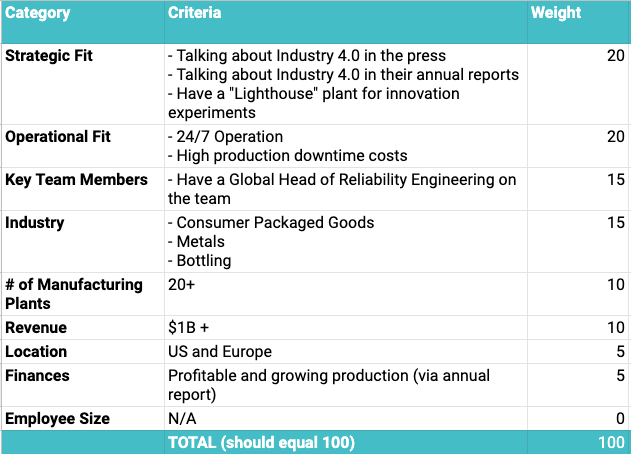

Rosansky shares an example from one of her past roles to illustrate this idea: “I worked for a company that sold a machine health solution to industrial manufacturers. Our TAM was huge — pretty much any company that manufactured any product. In the early days, with two SDRs, two sellers and no marketer, we needed to hone in on our ICP to maximize our limited resources. So we asked ourselves, what are the operational and strategic criteria that would make ABC Manufacturing a great fit for our solution?” she says.

Here’s a version of what they came up with:

“Once you can identify the strategic and operational criteria, those often help inform the other categories. So for example, ‘high production downtime costs’ is a key operational criterion that we can then use to narrow the industries down to the ones that have the highest cost per hour of downtime,” says Rosansky. “That’s a lot more actionable than ‘manufacturing companies in the US and Europe.’ Once we narrowed in on this ICP, our win rates started to increase significantly.”

Another common misstep? Treating this as a check-the-box activity. “As changes happen in the market (like new competitors and new innovation) and within your organization (shifting the business strategy or the product roadmap) these may very well impact your ICP. Don’t be too precious about changing things up,” says Rosansky.

Your ICP is never really “done.” It’s a living definition that needs to be revisited frequently, especially in the early days when you’re constantly learning new things about your product and the folks who use it.

FAQ #2: HOW DO I RUN A SUCCESSFUL SALES CALL?

Whether you’re on your first sales call or your 50th, chances are there are butterflies fluttering in your stomach when you fire up that first call deck — if not abject terror. “I hear this all the time from founders: ‘I’m just not a good salesperson,’” says Rosansky. She nips that right in the bud.

Founders are an innately curious bunch. But for some reason on sales calls, they’ll often just talk at the prospect for an hour, throwing them the kitchen sink versus getting deeply curious about what sorts of problems the prospect is facing and how their product might help.

Whether you’re trying to prep for your very first call, or have been at it for months, the imperative here is to practice. “The key to running high-impact sales calls is to have lots of at-bats and lots of coaching between those at-bats,” says Rosansky.

Here are four tactical tips for getting started:

- Record all of your calls. You can do this natively or use a low-cost tool like Grain or Copilot.

- Use a scorecard to rate your calls. You want to use the same scorecard for all of your calls so you have a consistent rubric and can see improvements over time. Here is the scorecard she recommends using specifically for discovery and demo calls, but it can also be repurposed for other call types.

- Ask for feedback. Have someone you trust listen back to the recording to score you on the same scorecard and provide you with detailed call feedback.

- Roleplay to improve. Sit down with that same trusted colleague to practice the areas where you struggle most — like when a particular objection arises, or when you get to the end of the call and try to schedule a second meeting.

But practicing aside, what actually separates a great sales call — one that closes deals — from a mediocre one that results in a “we’ll get back to you” non-commitment from prospects? Rosansky dishes out five action mandates for founders-turned-sellers.

Start with the PBC

“How many times have you been on a call with no clear purpose or agenda? It’s maddening, right? But time after time, folks dive right into their pitch deck without first laying out the path ahead for the duration of the call,” she says.

Enter the PBC, which stands for “Purpose, Benefit, Check.” “This one is the brainchild of my favorite sales coach, Craig Wortmann,” says Rosansky. The PBC is a verbal acknowledgment and agreement with your prospect on the purpose and desired outcome of the call. It might go something like this:

“Thanks again for taking the time to chat with me today. We initially set this call for 30 minutes, does that time still work for you? The purpose of the call is for me to learn more about your process and challenges for tracking SaaS metrics and share a bit about how [insert product] can solve that problem for you. At the end of the call, we can decide together if it makes sense to move to the next step in the process which is [insert next step details]. How does that sound to you?”

The PBC achieves a few key results right off the bat:

- Confirm alignment with your prospect on how they want to spend the time on the call.

- Earn the right at the end of the call to ask for a decision on the next step.

- Earn credibility and trust for the professional and polished approach.

“Most sellers don’t do any version of this so by starting with a PBC, you’re already setting yourself apart from the competition by building trust and credibility in the first two minutes,” says Rosansky.

Excavate the impact

Shadowing founders on their sales calls, Rosansky finds that most tend to stick to what she calls situational discovery questions. These might be something like, “What challenges do you have in your billing process today?” or “What tools are you using to manage your vendor billing?” Make no mistake about it — these insights are critical for figuring out if the prospect is qualified and has the right pain points that your product can help with.

But far too often, folks fail to dig deeper. “For example, I recently shadowed a call between a founder and a CFO. The CFO was very open about the challenges she’s facing with collecting critical SaaS metrics — it takes so much time, and she rarely even does it because she just doesn’t have the bandwidth. That sounds like the perfect fit for a SaaS analytics platform, right?” says Rosansky. “But the founder didn’t grab hold of the opportunity to dig into the impact of that pain. These sorts of questions might sound like ‘What is the business impact of your leadership team not having accurate insights at their fingertips?’ or ‘How do you know if you need to make major changes to headcount spending when you don’t have clarity into your revenue growth?’”

It’s not enough to know the pain the prospect has, you want to deeply understand the impact of that pain. That’s how you create urgency and turn a nice-to-have into a must-have solution.

Use the prospect’s own words

Rosansky’s next tip sounds simple, but it’s a potent (and underutilized) sales tool: callbacks. “If you do a great job with discovery on this first call, you’ve likely uncovered some really meaningful insights about your prospect. So what do you do with those insights? You leverage them to make an even stronger connection between the prospect’s challenges and the solution you’re building,” she says.

Here’s a simple example: “Let’s say during discovery your prospect told you they spend 20 hours per week dealing with vendor billing issues. Later in the call, when you’re demoing a feature in your billing platform you would simply say, ‘Earlier you mentioned you’re spending 20 hours a week dealing with vendor billing issues. With [xyz feature] you can eliminate those billing issues. How would this impact your workflow?’ Most sellers would just demo the feature and expect the prospect to make the connection on their own,” says Rosansky.

Tell stories to tap into emotion

“Storytelling is one of the most powerful tools a seller has in their toolbelt. Why? Because stories elicit emotion, and most purchase decisions are driven by emotion,” says Rosansky. We buy a new top because we like the way it makes us feel when we try it on in the store — that same principle applies to buying software.

Is it more powerful to show a slide full of statistics on the impact your product has had across your customer base or tell a story about a specific customer and how they went from struggling to scaling with your solution? If you said the latter, you’re right.

So look for opportunities to integrate storytelling into your discovery calls. “This can be the company origin story, stories about other customers who had similar challenges to the one your prospect is sharing, stories of customers who had similar objections to your product that the current prospect has (and how they overcame them) or stories of customers who ‘won’ using your product,” says Rosansky.

And use the storytelling approach to rethink how you run through your demo. “Most demos are so dry, ‘you can click here and do this and then click there and do that.’ I encourage folks to tell a story through the demo. This helps you focus on not just the feature and its function, but also the impact and value of that feature,” she says.

You’re aiming for the prospect to envision themself using your solution. Let’s say you’re building an employee onboarding product. Here’s how your demo might sound with this storytelling approach:

“Imagine you have an onboarding class of six new hires starting next Monday. Earlier you mentioned you would have to spend 20 hours coordinating across 5+ people to prepare for that class. With [insert product], this experience would look very different. You’ll only really need two days to prepare. First, you would come into the platform and [show feature function]. The impact of using [insert company name] to do [feature function] is [feature value]. Then the day before onboarding all you have to do is [feature function] which is much easier than what you’re doing now because [feature value].”

Don’t rush your closer

You’ve probed the prospect’s most pressing business challenges, unpacked how your solution might help, and ran through a demo that illustrates exactly how the customer could put it into practice. Before you know it, you’re at time, and your prospect is hopping to another call with a quick “We’ll be in touch” sign-off.

Don’t let this happen to you. “There are multiple critical boxes to check before you close the call, and folks end up in a race to beat the clock. Leave yourself enough time — no matter where you are in the demo, stop at the five minutes left mark to start closing out the call,” says Rosansky.

Here are the five steps to ending a sales call the right way.

- 1. Ask for feedback. “I find that a lot of founders are hesitant to ask for feedback — no one wants to be told that their baby is ugly. But a simple, ‘I’ve shown you a lot today, what are your thoughts right now?’ can tell you a lot about whether to continue investing in the relationship.” Remember the PBC? This is the moment to close that loop, says Rosansky: “As we talked about at the beginning of the call, the benefit of this conversation is we both have enough information to determine if it makes sense to move to the next step. What are your thoughts on moving forward?’

- 2. Outline the next steps. “Always schedule the next conversation while you’re still on the call. Once you hang up, it can be near impossible to get that person’s attention again and you’ll lose momentum,” says Rosansky. “Also recommend (don’t just ask) who else should be on the next call. If you know the engineering leader will be a key stakeholder, ask who they are and if they can join the next call.”

- 3. Mind your manners. “Say thank you — it’s so simple, but you’d be surprised that the little things go a long way in creating a relationship and being the type of person people want to buy from.”

- 4. Follow up the same day. No matter how busy your calendar is for the rest of the day, make sure you get a follow-up email out before EOD. “Include a summary of the discussion, what you learned, any action items you owe them (like if you didn’t have an answer to a technical question, here’s where you’d put that) and the next steps you agreed to. Plus another thank you!”

- 5. Share out. “You want candid feedback about how you did on the call. Send a recording to someone you trust to share feedback about how you can improve.”

FAQ #3: HOW DO I FIGURE OUT THE RIGHT GTM MOTION FOR THE BUSINESS?

How will folks come into contact with your solution? Rosansky shares some guiding principles to keep in mind when weighing whether to take a more hands-off, self-serve approach or let sales lead the charge here. And for the sales-led motion, she also unpacks her framework for whether to introduce a pilot (and how to do it right).

PLG vs. sales led?

Product-led growth is incredibly appealing — for one, it’s significantly less expensive than hiring a sales team to track down leads and close deals. But before going down that route, Rosansky outlines the boxes you need to check.

- Is the product truly self-serve? “Are people going to be able to land on your site and touch your product without talking to a salesperson? Is it easy to sign up, very intuitive, without a complicated onboarding or integration required? Or are they going to abandon it halfway through the setup because it’s too complicated? You want folks to quickly experience the value realization moment with zero friction.”

- Is there some virality to the product? “Are there network effects where the product can grow organically as folks share with other people on their team?”

- Does your user want to self-serve? “If you’re targeting a technical user, they typically prefer not to engage with salespeople. They want to be able to play around with the product themselves, without being gated by a sales rep.”

- Can your user buy? Will they be able to purchase the product or will they have to bring in a boss?

- How big are your deals? “If your ACVs are $10K or less, your margins can look much healthier with a self-serve motion.”

But it’s important to note, Rosansky points out, that even if you check off every box on this list and go the PLG route, make sure you’re still talking to customers rather than delegating them entirely to a sign-up page. “When you’re super early, everything should still be sales-led. You’re still figuring out your ICP and personas — and that requires talking to customers,” says Rosansky.

And once your PLG is humming along, you’ll return to sales to start closing bigger deals. “Assume that as you go up-market that you will layer sales into your self-serve motion to drive more top-down deals, consolidating all the different individual and team accounts into one big enterprise account,” she says.

Should I run a pilot?

You think you’re close to closing a deal. The prospect seems promising — they acknowledge they have the problem your product is addressing. But there’s something holding them back from signing on the dotted line. They might be worried about change management — can they actually get their team to use the tool? Or they’re unsure of how the tool will integrate with other platforms. Or they’re not totally sold on the technical capabilities that your demo is touting.

So, to try and keep the deal alive, you float an idea: What if we do a pilot? Seems harmless enough — after all, you know your product is perfect for them and they will love it and you’ll have a deal closed soon.

“The worst case scenario is that your prospect has an objection or some sort of friction that’s holding them back. So you offer to do a pilot, but the pilot isn’t designed to actually help them overcome that trepidation. Now you’ve spent weeks (or even months) of your team’s time,” says Rosansky. “Or you have a very technical buyer and you’re trying to get them to agree to four phone calls within a week to kick off a pilot. And you’re creating friction when they would have just bought from you without the pilot.”

A pilot in the right scenario is a sales superpower. When done poorly, it can be a major blocker in getting the deal done.

So how do you do it the right way? Get clear on the three Ps of the pilot: Purpose, Process and Prerequisites. Here are some questions to consider when weighing adding a pilot to your sales process:

- Purpose: Get aligned with your prospect on the purpose of the pilot to ensure you design it correctly to explicitly help the prospect overcome their objections or concerns. “Be very direct in asking about what makes them anxious or uncomfortable. If they’re worried about change management and getting their team to use the product, a two-week pilot isn’t going to change that objection so you’ll need to come up with a different solution.” And consider the right length of time for the pilot process — how long will it take the prospect to have a value realization moment from the moment you kick off the pilot? “Ideally, your pilot should be under 90 days. If it’s going to take six months for the customer to see the value, maybe because there are some thorny integrations, you should only consider doing a paid pilot. Otherwise, six months is way too long to be servicing a customer for free.”

- Process: Oftentimes after the pilot kickoff the prospect goes radio silent and you don’t have a grip on what they’re thinking about the product. Put a process together that enables you to check in, get feedback and stay on top of the pilot success criteria.

- Prerequisites: One example prerequisite for moving forward with a pilot is identifying a champion. “Do you have someone who is committed to spending X hours a day or week getting into the product and realizing the value, and championing that value to the team?”

Borrow this template from Rosansky to input your pilot process and prerequisites before moving forward with signing anyone up for a trial run.

FAQ #4: HOW DO I FORECAST ACCURATELY?

Depending on your product and the companies you’re selling to, sales cycles can be quite long. So when you go to set your quarterly or annual goals, trying to make a projection can feel like you’re expected to have a crystal ball. So you jot down some aspirational numbers and hope for the best.

“Founders sometimes treat sales like a black box. There’s this feeling of, ‘We’ll just try our best and hope to hit that number.’ But hope is not a strategy,” says Rosansky. “The reality is, most forecasting is done based on gut instinct and a lot of optimism, not based on facts. Why does this happen? Because we lack data! And when we lack data, we lack insight and we can’t take action — or our actions are misdirected.”

Funnel health is just like your own health. You don’t just hope that everything’s fine — you go to the doctor, run some tests and get a proper diagnosis.

But with a carefully-built sales process and funnel, more predictive insights can be right at your fingertips. “Being in the weeds of what's happening on a weekly cadence and then iterating and making changes when things are not working — that's doing it right. But I don't often see that,” she says. “You might not have perfect 20/20 vision of the road ahead, but you’ll be far from flying blind.”

Oftentimes, this is a can folks kick down the road and return to forecasting once they’ve built out a sales org. That’s a mistake, says Rosansky. “Whether you’re selling alone or have a handful of reps, getting into the forecasting practice early (and often) will save you a lot of headaches later on.”

She unpacks lower-lift, startup-friendly ways to build and check up on your funnel.

Define and track your funnel

A simple B2B funnel will have these steps:

- Meetings set: The number of first meetings you book.

- Meetings Executed: The number of first meetings that actually happened. (These can also be called “opportunities” because you should open an opportunity for every meeting you execute.)

- Opportunities Qualified: The number of opportunities that fulfill your qualification criteria (i.e. align with your ICP).

- Optional: Trial or Pilot Kickoff: If you have a trial period or pilot as part of your sales funnel, include the number in that stage.

- Closed-Won: The number of deals that have been won.

But just listing out the steps isn’t enough — get crystal clear on the right flow from step to step. “For each stage, you need to articulate: What is the goal in that stage? What are we trying to accomplish? And what are the exit criteria to move to the next stage?” says Rosansky.

It’s a common tripwire for early-stage startups that can come back to bite them later on. “You can’t have folks qualifying opportunities differently. I’ve seen later-stage companies that realize that their sales teams are all approaching each step of the funnel with different exit criteria in mind. Get specific early on,” she says.

Once you define your funnel stages, you have to consistently track these key metrics. Whether you’re doing it in a spreadsheet (in the early days) or in a CRM, that historical data will prove to be incredibly helpful in future forecasting.

Build a realistic forecast

Once you’re clear on the funnel stage definitions, you can start to build out your forecast. “A monthly waterfall forecast takes into account your current (or expected) conversion rates across each stage of the funnel, your average sales cycle and your average contract value,” says Rosansky. “This will bring the closest thing to a source of truth for how many first meetings you need each month to achieve your future new business revenue goals.”

Copy Rosansky’s waterfall forecast template to get started with your own funnel model.

Next, get a meeting on the books. “I recommend a monthly 90-minute meeting with your team to review where you actually landed compared to your plan, to see where you’re on or off track, and create an action plan to address any funnel challenges that you identify,” she says.

Here’s an example: “Let’s say your meetings executed conversion rate is only 70% of the meetings you set. You can put some new tactics in place to make sure more people are showing up to that first meeting — like call reminders, nurture emails or short teaser demo videos,” she says.

Make it a weekly habit

Ditch the set-it-and-forget-it approach — Rosansky strongly recommends making forecasting a weekly ritual, whether you’re still doing founder-led sales, or have started to build out a team.

For starters, make sure you keep your opportunities up to date — in the correct stage with an accurate close date. Rosansky recommends setting 30 minutes aside each week to update all the stages and close dates. “Opportunity hygiene is the only way to get forecasting truth,” she says.

Set a recurring forecasting meeting — and bring other folks into the fold. “Early on, I recommend having more than just sellers in this meeting. Your marketing, product and engineering folks can learn a ton from sitting in these meetings. They may even have some creative ideas for how to get deals over the finish line,” says Rosansky.

Ahead of the forecast meeting, ask sellers (if you have any) to send their “commit” number: opportunities that they are committed to winning that period, which can be weekly, monthly or quarterly depending on your sales cycle, along with their best case opportunities that they might be able to win during the period.

And it’s on the person who owns this meeting (in the early days, probably the founder, but eventually a Head of Sales) to gut-check the forecast. Rosansky recommends probing deeper with a few key questions:

- What are the next steps you and your prospect are taking to move this deal forward?

- What are the risks you see in getting this deal closed won by the date you’ve committed to?

- What are the objections this prospect has had throughout the process?

- Let’s say it’s next month and this deal ends up being Closed-Lost. Why do you think this would have happened?

“Based on the answers to the above, you can determine any tactics or plays to reduce risk and address blockers. You should come out of this meeting with an updated forecast and an action plan,” she says.

And make sure to leave space to step back from the quantitative numbers and trade qualitative feedback — either as part of the weekly forecast or in a separate “sharing is caring” meeting. “The goal is to understand what the team is hearing from prospects and customers. Ask each person to come to the table with one thing to share — like an objection they got and how they responded, a new competitor they heard about, or a theme that’s cropped up in a few different prospect conversations,” she says. “Your frontline folks will have plenty of insights that might not be captured on a spreadsheet.”

You can also bring in a tool to augment here: “I would argue a conversation intelligence tool like Gong should be one of your first investments in the sales tool stack. These tools give you the ability to listen and comment on sales calls and they use AI to surface keywords, phrases and themes across your calls. For example, if a specific competitor is coming up often in sales calls, you can see that with Gong. Or if you want to share the way one of your reps handled an objection with the rest of the team, you can do that in Copilot.”

WRAPPING UP: TAP INTO YOUR FOUNDER SUPERPOWERS.

To close us out, Rosansky reminds founders that becoming a solid salesperson and stepping into a go-to-market mindset doesn’t mean tossing out all of the things that make you an incredible builder — in fact, you should probably be tapping into those things even more directly.

“If I think about the traits that make an exceptional seller, I think about folks that are deeply curious. They’re analytical, solution-oriented, and customer-obsessed — and they’re doggedly persistent,” she says. “Sounds a lot like how you’d describe a founder.”