This article is by Dee Sahni. Dee was Head of Monetization at Clutter and VP of Product at Figment. She spent 6 years in ad-tech at Google and Quantcast. She also advises companies on pricing, packaging and business models.

It was midnight. Sam was two months into a new job when he received a call from the CFO, asking for a nationwide price hike. Sam worked at a luxury goods startup, with prices at the top tier of the market. A 30% price hike on an already premium product seemed excessive. But it was a new job and Sam was eager to impress. "Raise prices to increase LTV. This is going to be an easy gig."

Famous last words.

What started as a trivial price increase evolved into a sweeping transformation touching everything from the guts of the software systems to the consumer funnel and brand. From the business model to what they sold and the composition of their user base. Even how they measured and reported success changed.

At the end of eight months, Sam achieved unit-economic profitability. He 2xed LTV/CAC and brought the payback period to under a year — all while keeping revenue constant. Contrary to intuition, he also lowered price points for their most valued customers.

How did he do it?

A company's margins water down as it grows. This is natural because as its customers diversify, features and prices that worked for a niche start losing oomph at scale. You won’t have the same LTV and margins at 10,000 users as you did at 100.

The first instinct to plug the hole is to raise prices. And price resets can create significant wins. But if minor changes in price cause massive fluctuations in output-KPIs, there's a deeper problem: Your product is not working.

The solution is to build a more diversified, customized product and pricing model — moving away from one-size-fits-all and towards granularity. By doing this, you won't only improve your unit economics, but your product itself will become more appealing.

This is different from last-ditch price changes dictated by finance teams, where price becomes a compromise between business needs and customer experience.

Powerful monetization doesn't take away from customer experience. It rides on it. In the best cases, it improves the experience. Thoughtful monetization can even reduce prices.

In the following four-step framework, you’ll break down your user base into value-driving segments, sketching out each segment in four buckets: Needs, Willingness-to-pay, Demographics, and Behaviors. You’ll use these segments to create product and pricing models that scale gracefully.

And while there's a plethora of writing on innovative pricing models and strategies, this framework will show you how to adapt these models to your product and your business. You’ll learn how to layer pricing models and customize them for your users.

THIS FRAMEWORK IS FOR YOU IF:

- You’re on the CFO’s speed-dial list. Similar to Sam, your finance team regularly recommends price changes: new prices, tiers or subscriptions. You are not alone. This common pattern points to a pricing model that doesn't work, or a product customers don't want to pay for.

- You’ve nailed PMF and want to add revenue. So far you've focused on growing DAUs, retention, network effects, etc. (like Clubhouse). But how do you take a product with strong traction and build a lasting business?

- Growth is too cash consumptive… and it’s a hard fundraising environment. Your cost of goods sold is significant, (like Casper). You're spending $20 to make $10.

- Your marketing CAC is too high. You've tried everything to lower CAC and have a stellar marketing team. It may be time to focus on your product.

- Your LTV-CAC needs improvement. Your unit economics are decent, but not great. Can you get to an LTV/CAC of 3.0?

- You have a product users love, but… you don’t know how to monetize it. You don't want to alienate them with forced monetization, like ads. Can you nurture this customer love and still make money?

- Your payback period is too high. It takes 24 months for the average customer to become profitable. You have 12 months of cash runway. You need to choose between growth and staying alive.

You'll eventually face the pressure to add revenue or improve profit margins. This pressure will force slapstick changes like price increases or more ad spend. These changes, while necessary, are a stop-gap. In the long run, they will hurt your ability to grow and scale.

This framework will show you how to add monetization while sustaining growth. Done well, it will help you unlock new growth.

The framework is business-model agnostic. It applies to both low-marginal-cost products that want to add new revenue (like LinkedIn and Twitter), as well as high-cost-of-goods-sold products looking to improve margins (like HelloFresh). We’ll cover two types of problems:

- Adding New Revenue: In the early 2000s, LinkedIn had a latent asset — an engaged social network, but they needed to monetize it. Through a series of pricing innovations, LinkedIn today has become the poster child of pricing case studies. It's seen strong revenue growth, even as user growth has plateaued.

- Improving Unit Economics: Amazon Prime promised free delivery to create growth. This came at a substantial cost to the business. We'll walk through some examples of how they navigate this customer promise and key product differentiator while delivering strong unit economics. Most products with significant costs-per-order share this problem.

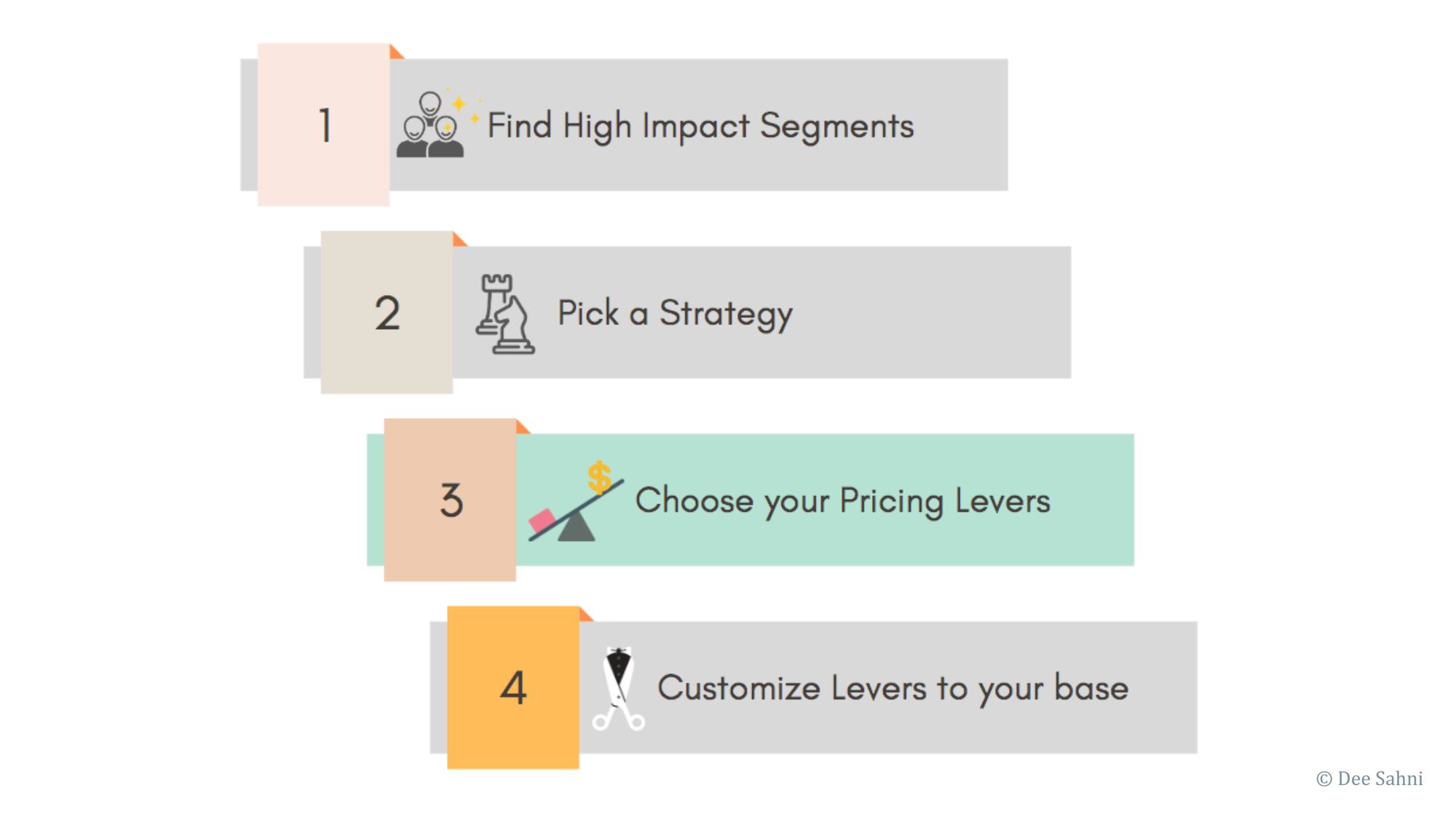

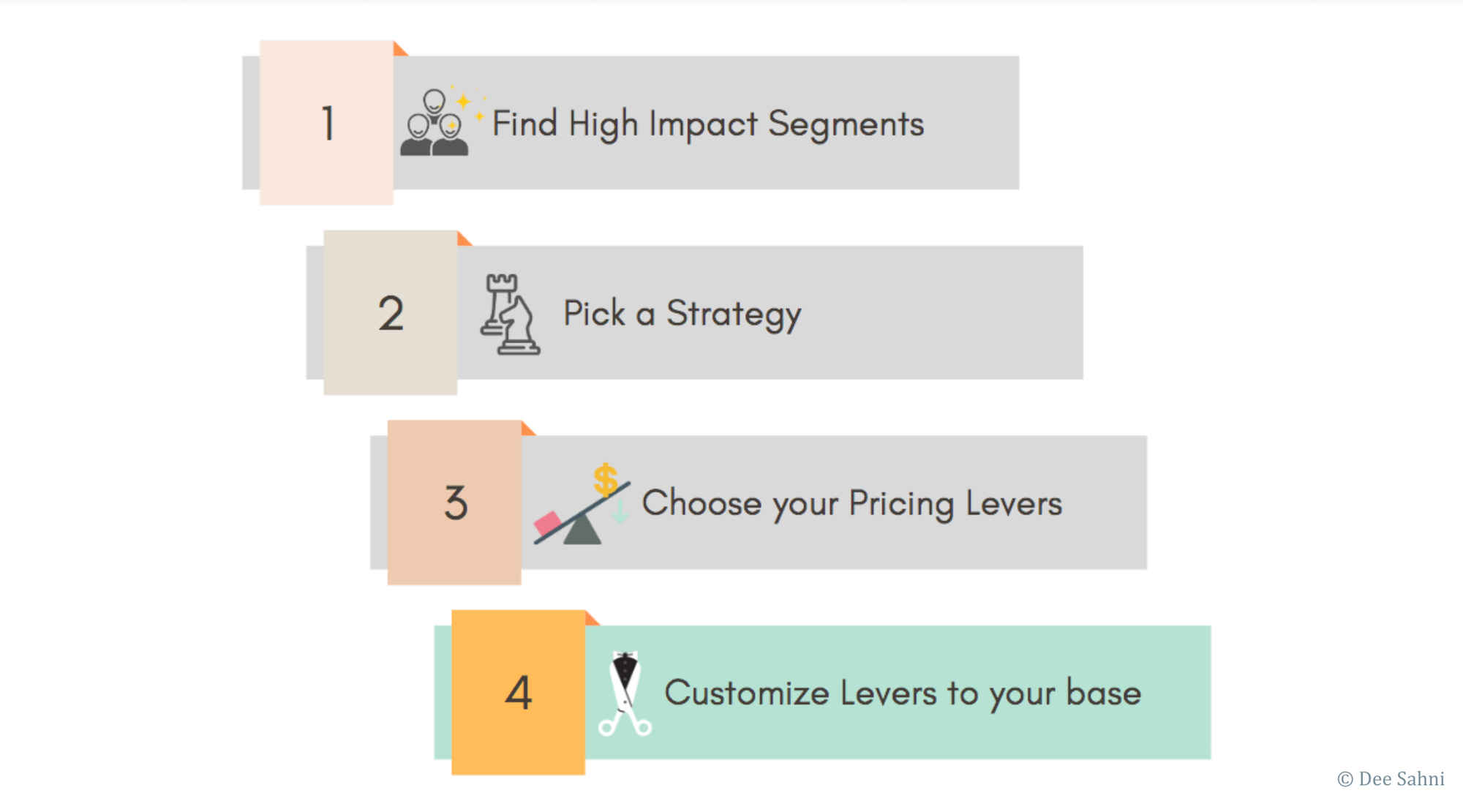

FOUR STEPS TO SCALABLE PRICING

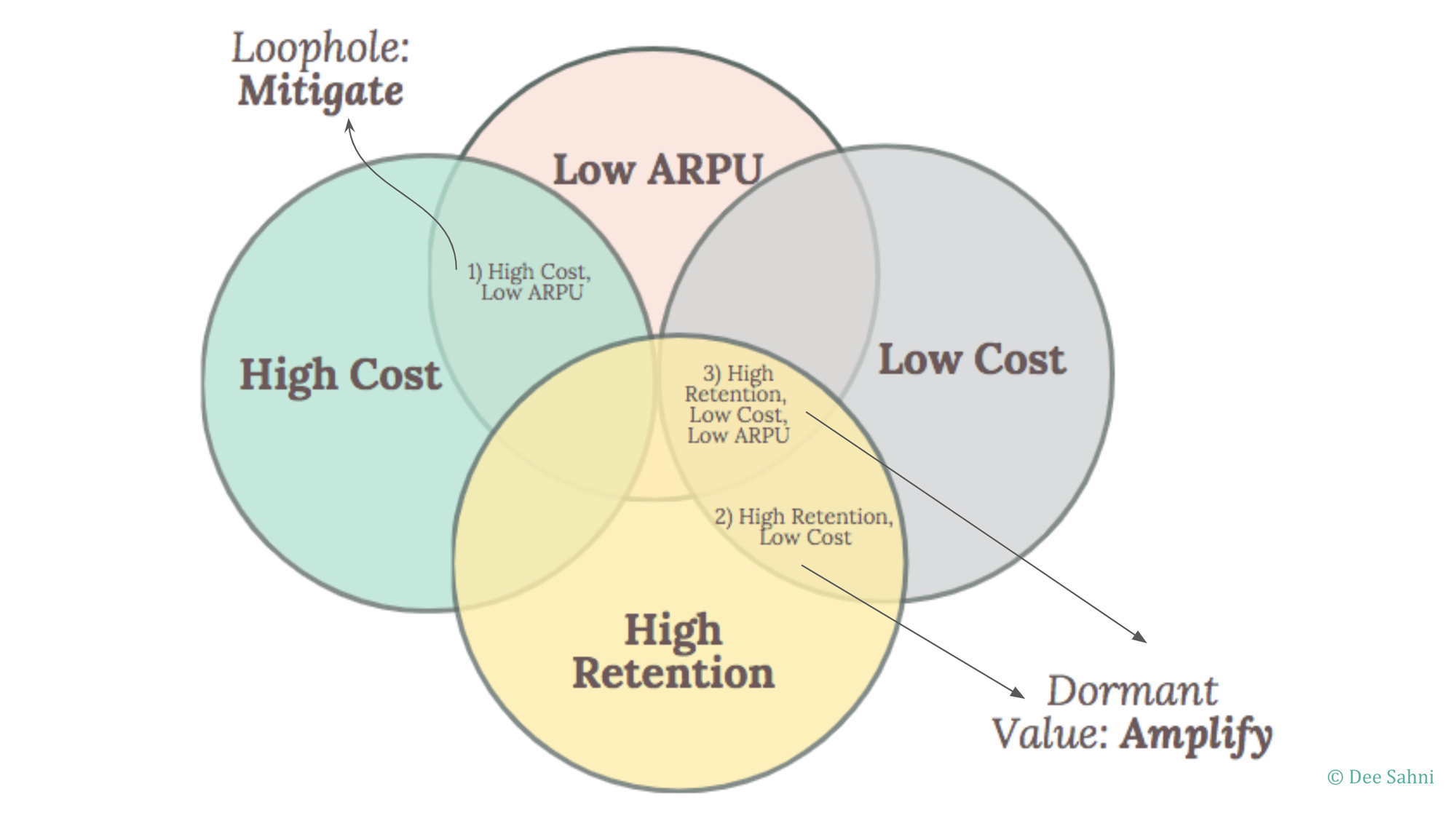

In the most acute margin challenges, you can isolate the problem to a few distinct cohorts that disproportionately impact averages. For example, large segments of high cost, low ARPU (average revenue per customer), or low retention users.

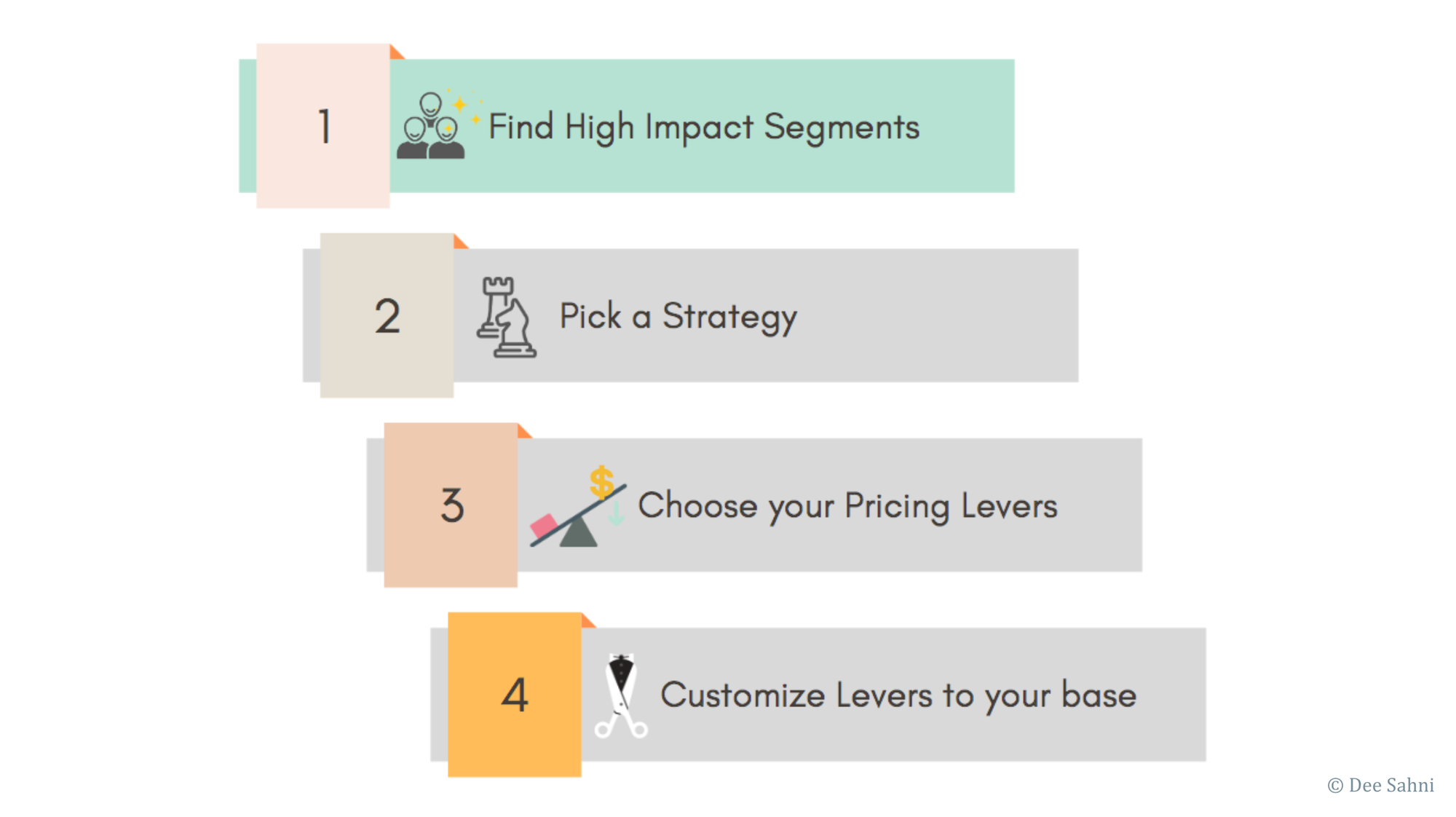

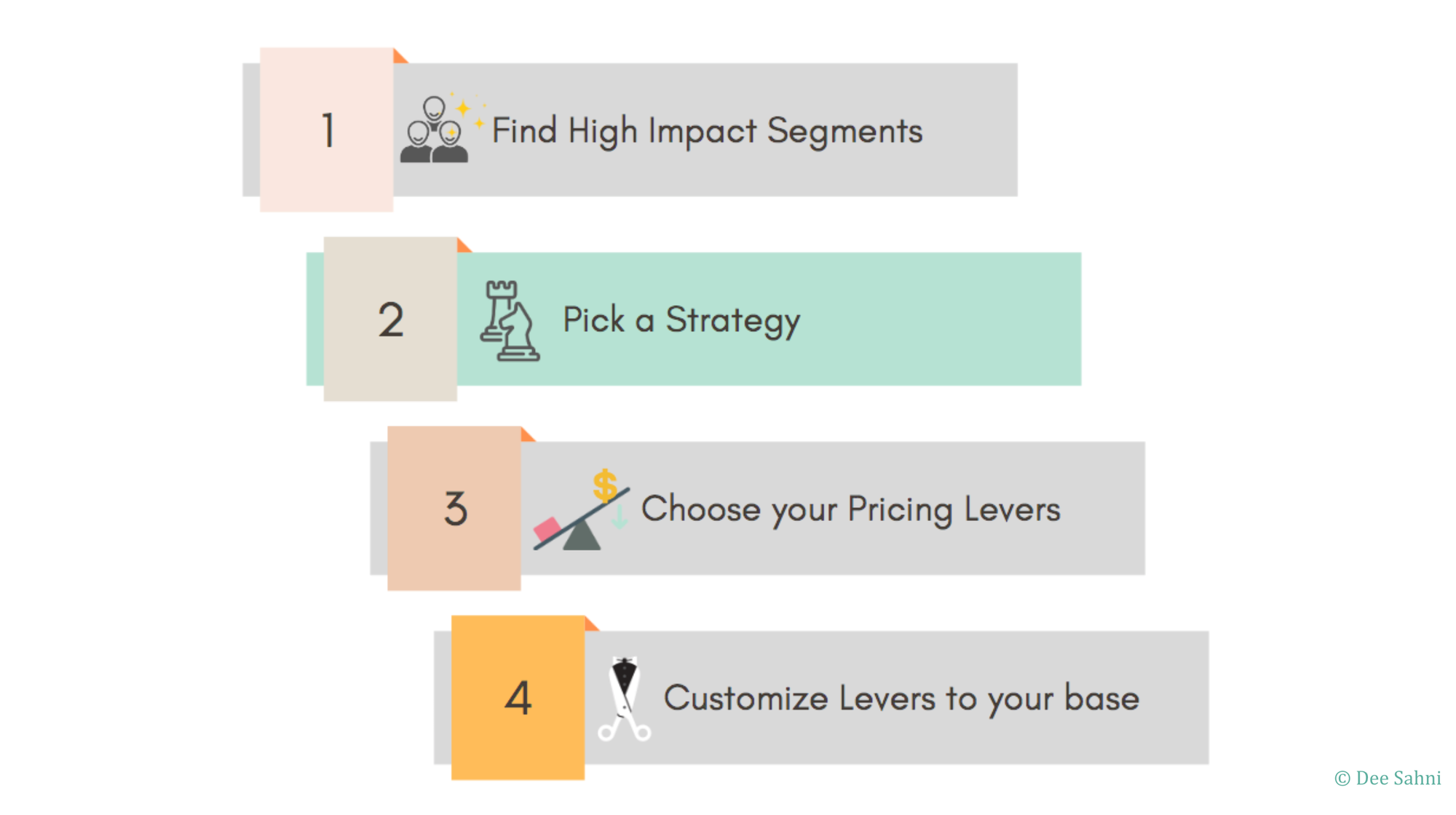

We'll transform the impact of these offending cohorts through a four-step framework. These steps include: Finding high-impact segments, picking a strategy, designing pricing levers to execute this strategy and customizing these levers to our user base.

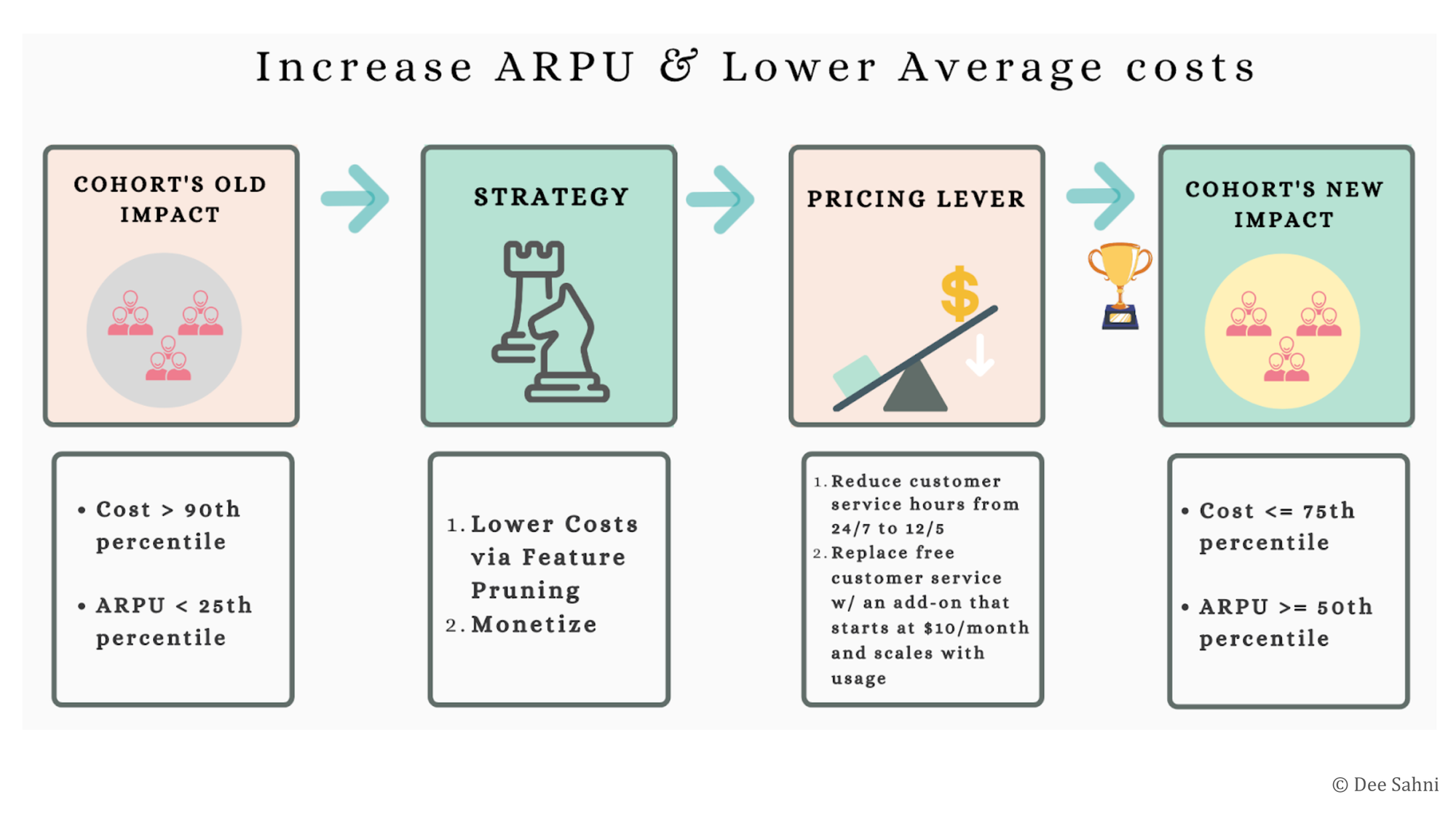

To illustrate this, here’s how we transform "a high-cost, low ARPU cohort" into a "medium-cost, medium-ARPU" cohort, using Amazon Prime as an example.

- One: Segment customers around impact. Our process starts with grouping customers into dominant high-impact cohorts. For example, if Amazon Prime's unit economics need improvement, one of the most important cohorts is that of "high-cost customers" given its free delivery.

- Two: Pick a strategy. Based on a cohort's impact, we'll pick a pricing strategy. In the Prime example the strategy could be (a) reduce the size of high-cost cohorts, (b) monetize them higher, (c) reduce the cost of delivery for these users.

- Three: Choose a pricing lever to implement your strategy. We'll pick from a menu of pricing models and levers. In the Prime example, our levers can be (a) incentives to reward low-cost behaviors, like credits to encourage shipment batching, or (b) fees to monetize high-cost deliveries. Prime innately uses a subscription lever to improve retention and therefore LTV.

- Four: Customize. Our levers need to be targeted to specific segments and user behaviors. We'll do this by using customer attributes. Attributes such as distance from Amazon fulfillment centers, zip codes, behaviors such as ordering one item at a time, how urgently this delivery is required, etc. will determine what pricing, policies, discounts, incentives, dynamic pricing, etc. to use.

STEP 1: FIND SEGMENTS WITH HIGH IMPACT

Avoid the pitfalls of the mythical average customer through segmentation and targeting. We’ll borrow this line from Madhaven Ramanujam and Georg Tacke’s book “Monetizing Innovation”:

We have not found a single market where customer needs are homogenous. Yet, time and time again, companies design products for the average customer.

Your user base is a combination of customers with different types of impact.

Say you’re in the early days of Netflix and want to improve unit economics, with analysis showing that both CAC and retention are substantially underperforming.

- CAC: You notice one particular cohort with significantly higher CAC: non-US customers, specifically India and Brazil. You notice that US prices are too high for these cohorts. And Netflix's content libraries are too US-specific. This makes both the product and its price unappealing to these users.

- Retention: Retention is particularly low for customers interested in niche content such as Anime. A possible fix could be to find the largest cohort with poor retention and improve the content in that vertical, leading to better overall retention.

Conversely, say you’d like to improve fitness and health wearable product Whoop’s unit economics. You find a high retention cohort that uses the Whoop device for several months, even years. This cohort is 20% of the total user base and its LTV is 2-3x the average. You can increase the size of this cohort and improve over LTVs.

A high-impact segment can have either positive or negative value, like an extremely high LTV or a negative LTV. Depending upon segment size, both positive and negative-value cohorts can lead you to untapped opportunities:

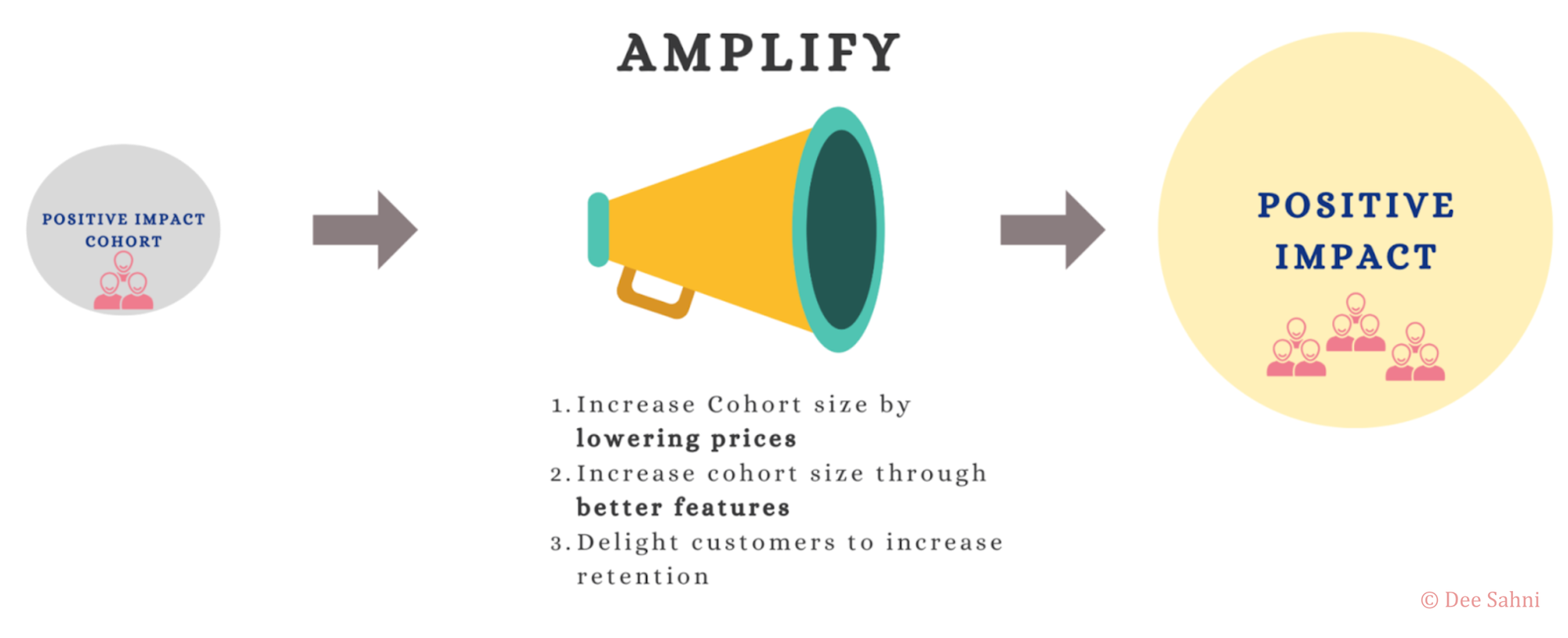

- Positive-value cohorts hint at hidden value waiting to be amplified: Usually rests in a small set of high-value customers. e.g. high price point, high retention. How can you delight them and improve their value further? Is there a new set of features or positioning to attract more of these high-value customers? In the next step, we'll amplify the value of these cohorts.

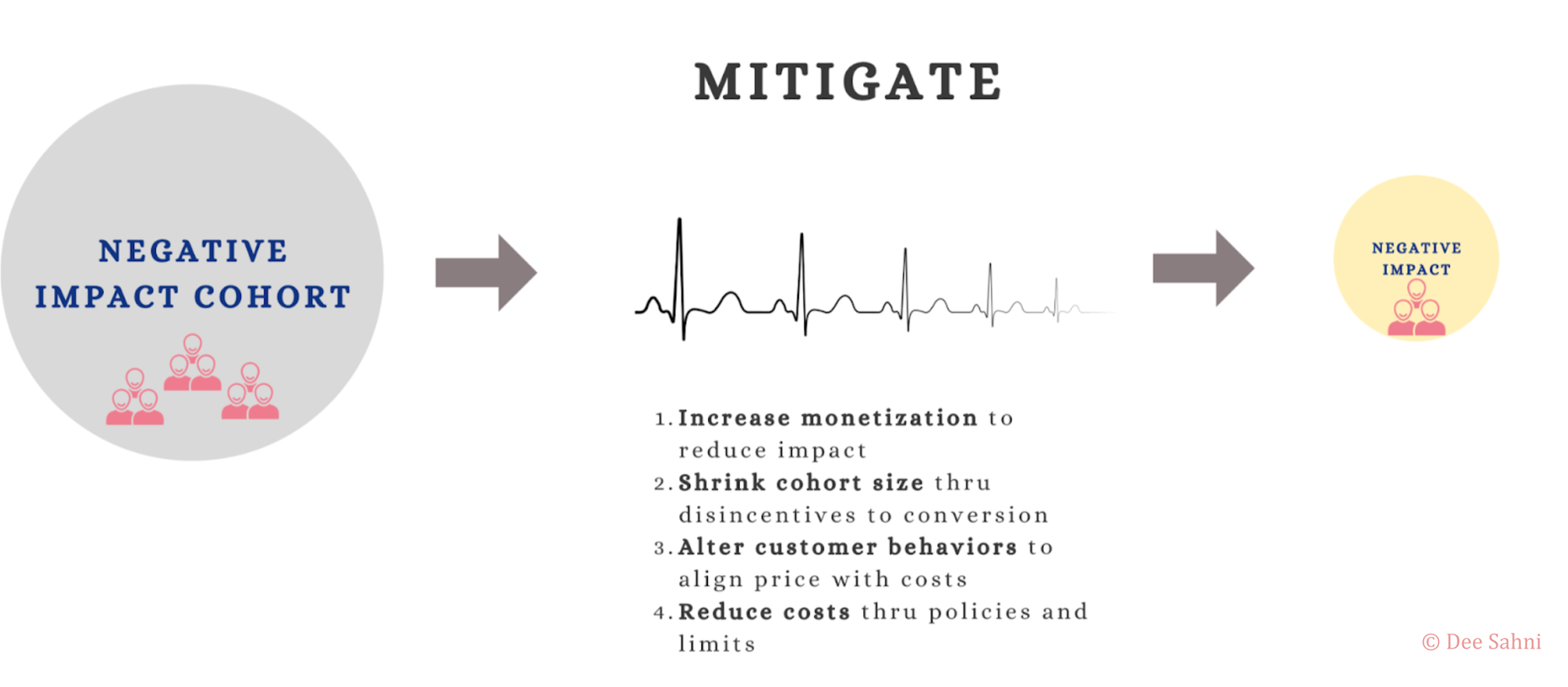

- Negative-value cohorts hint at loopholes you can mitigate: Usually rests in low-value or loss-generating customers. Most pricing is done to hit a margin or LTV goal over in aggregate. Meaning there will always be a few negative-value customers. The size and scale of their negative contribution should be monitored. If not, their damage can compound. In the next step, we'll mitigate the value of these cohorts.

Tips on how to build high-quality cohorts

Based on what your target goal is — reducing costs, adding monetization, etc. — you'll rely on different ways to cohort and bucket customers.

Use your target metric to create cohorts

In the Prime example, you can bucket all customers by their costs. To create a good cohort, play around with a percentile cutoff point, e.g. top 20th percentile, top 5th percentile.

Use proxy metrics to create cohorts

In the LinkedIn monetization example, you'd like to increase the ARPU. But this is back in 2004, and no pricing has been implemented and ARPU is close to 0. So you can't practically cohort customers around ARPU.

Instead, you'll find a proxy metric for ARPU. "How can I segment customers around their monetization potential?" Options may include measurable metrics such as the number of logins, searches, connections, conversations, etc.

Cohorting is valuable. But you can also inadvertently create cohorts with very little signal. Create high-quality cohorts by:

- Finding good cut-off points: What does high cost mean exactly? Is it the top 20th percentile or the top 5th? A good cutoff point will create a cohort with very distinct customer attributes (which we’ll cover more in step 4) and will help build packages and tiers that are strongly differentiated from one another. Differentiation will make it easier for the user to self-select and also creates a stronger sense of value delivered. For example, LinkedIn’s Sales Navigator could cohort by "saved leads," playing around with the exact value of saved leads that give you four cohorts that correspond to actual user personas: Premium Business users, Sales Pros, Sales Teams and Sales Enterprises.

- Picking the right number of cohorts: In the LinkedIn example, you can go beyond creating just two segments — high and low monetization. e.g. Small, Medium, Large, XL. Looking ahead, these will start corresponding to LinkedIn's 4 priced tiers. Alternate cohorts will give you contrasting data when you customize your pricing model. For example, if you see a substantial difference in the number of searches performed by a Small and XL cohort, you'll know that the number of searches has a higher value for XL cohorts and can potentially be monetized.

STEP 2: PICK A STRATEGY TO TRANSFORM THE IMPACT OF THESE COHORTS.

Amplify positive-impact cohorts

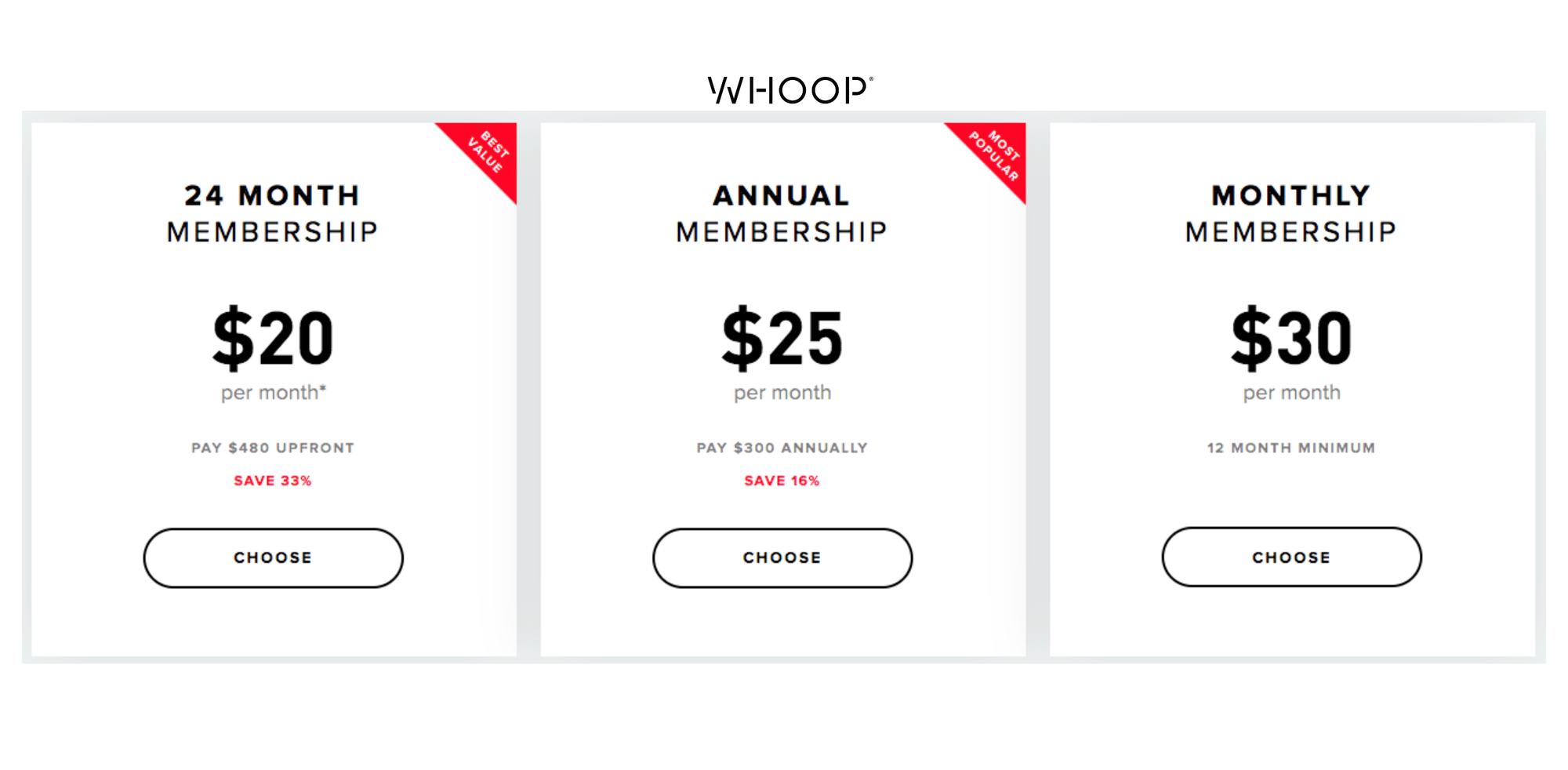

Whoop uses subscriptions to lower prices to encourage customers to opt-in, thus increasing the size of high retention cohorts and overall retention.

When a cohort is over-performing, e.g. a high-retention, high-LTV cohort, you’ll want to amplify its impact by increasing the cohort size, or increasing retention (or both).

Common ways of doing so include:

- Increase cohort size with lower prices, improving conversion rates: Increasing the size of a high-retention cohort will drive average retention up. Whoop increases the size of its high retention cohorts by offering lower prices for longer subscriptions.

- Increase cohort size through better feature sets and better conversion rates. Amazon Prime grows the size of its high-retention cohort by offering the free deliveries feature.

- Delight these customers to further improve retention and repeat purchases. Loyalty programs, discounts and rewards are easy ways to show these customers they're valued. Nordstrom is famously known for its stellar customer service as a means to retain high-value customers. Similarly, Wayfair offers members-only discounts to reinforce loyalty.

Mitigate negative-impact cohorts.

When a cohort is underperforming, e.g. high cost, low ARPU, you’ll mitigate its impact.

Techniques include:

- Changing customer behaviors to lower-cost behaviors. For example, Amazon Prime asking you to group more items in the same shipment reduces overall costs.

- Increase cohort monetization: Amazon Prime offers free delivery of bulky items. But monetizes high-cost behaviors such as delivering furniture to a "room of choice."

- Shrink cohort size: e.g. If you anticipate a user will have negative LTV, you can price them higher to reduce conversion rates.

- Reduce costs: Create policies, prices, algorithms, etc. that incentivize high-cost customers to low cost. For example, Snowflake incentivizes users to proactively optimize costly compute usage through pay-as-you-go pricing and charging more for compute than storage.

STEP 3: BRING YOUR STRATEGY TO LIFE WITH PRICING LEVERS.

We'll use the term "pricing lever" to refer to any part of your system that affects monetization. This includes:

- Product

- Pricing and business model

- Value prop

- Brand and Messaging

These work in tandem to deliver a coherent price experience. Changes to one will affect the other. e.g. if you change your price model from flat to usage-based, you'll have to change your value proposition and messaging.

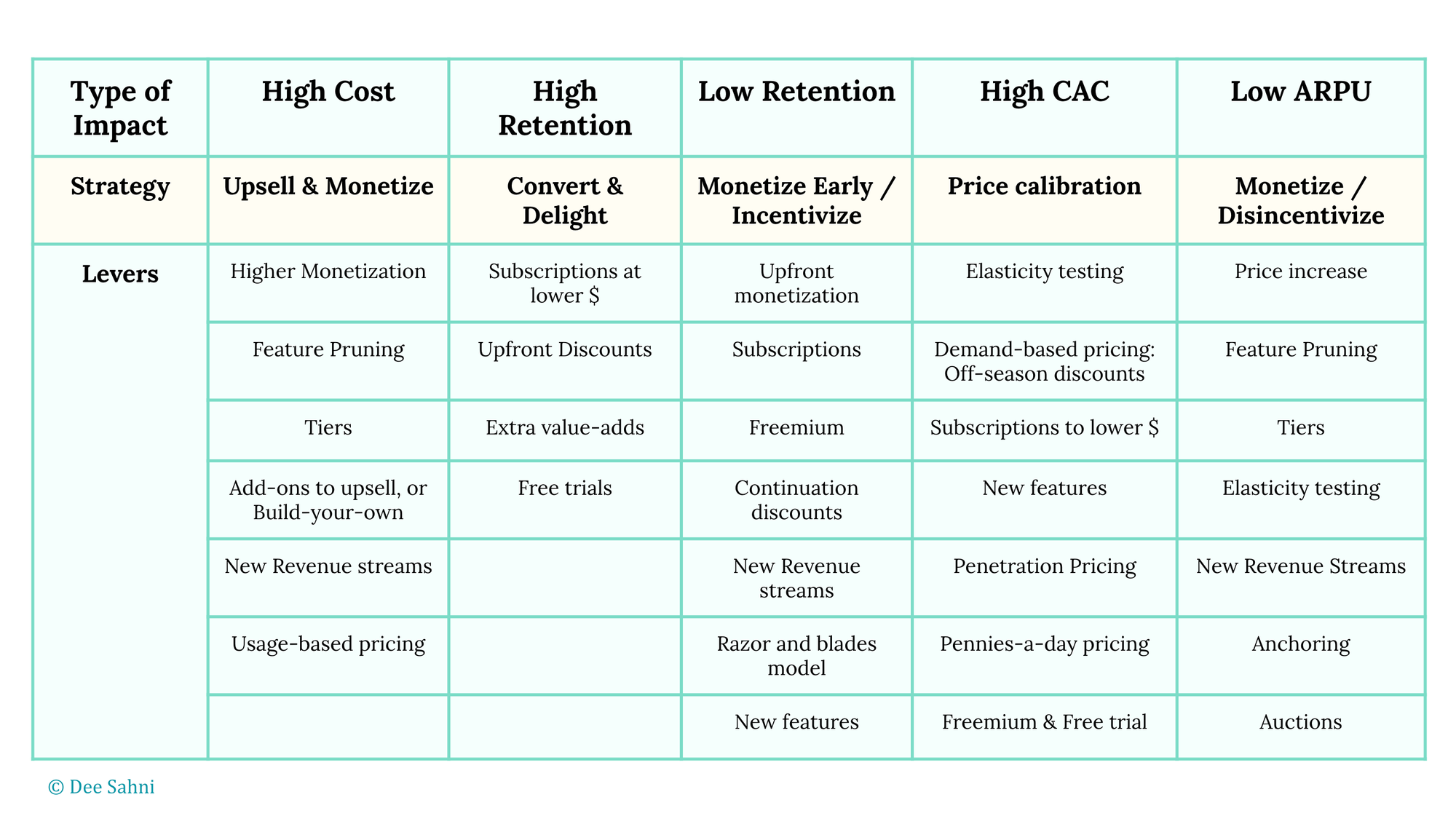

Pricing literature is rife with models to choose from. The table below shows how your cohort impact and pricing strategy can help you choose a model.

In practice, cohorts can have combinations of impact: high retention + low ARPU, high cost + high retention, etc. Pricing levers and models can overlap to address combinations, like tiers with pay-as-you-go or demand-based pricing.

Below is a trivialized example of a transformation.

Say your product has tiered pricing with free customer support for all tiers. You've noticed overall costs are too high and ARPU is lower than competitive benchmarks. Step 1 analysis shows this is coming from a single cohort: Customers on the low-priced tier, with high customer support usage.

Our strategy is a combination of lowering costs and adding monetization. Some options to do this:

- Lower costs with feature pruning Options may be to cap customer support hours or remove it altogether. We'll choose to reduce the support window from 24/7 to 12/5.

- Monetize customer service as an add-on, based on usage. To minimize impact on customer satisfaction, we can also continue to offer free customer support to high-priced tiers.

These changes reduce cohort costs from being in the top 90th percentile to being in the top 75th percentile. It also increases ARPU and brings it to the median.

STEP 4: DRIVE OUTCOMES BY CUSTOMIZING LEVERS TO YOUR USERS.

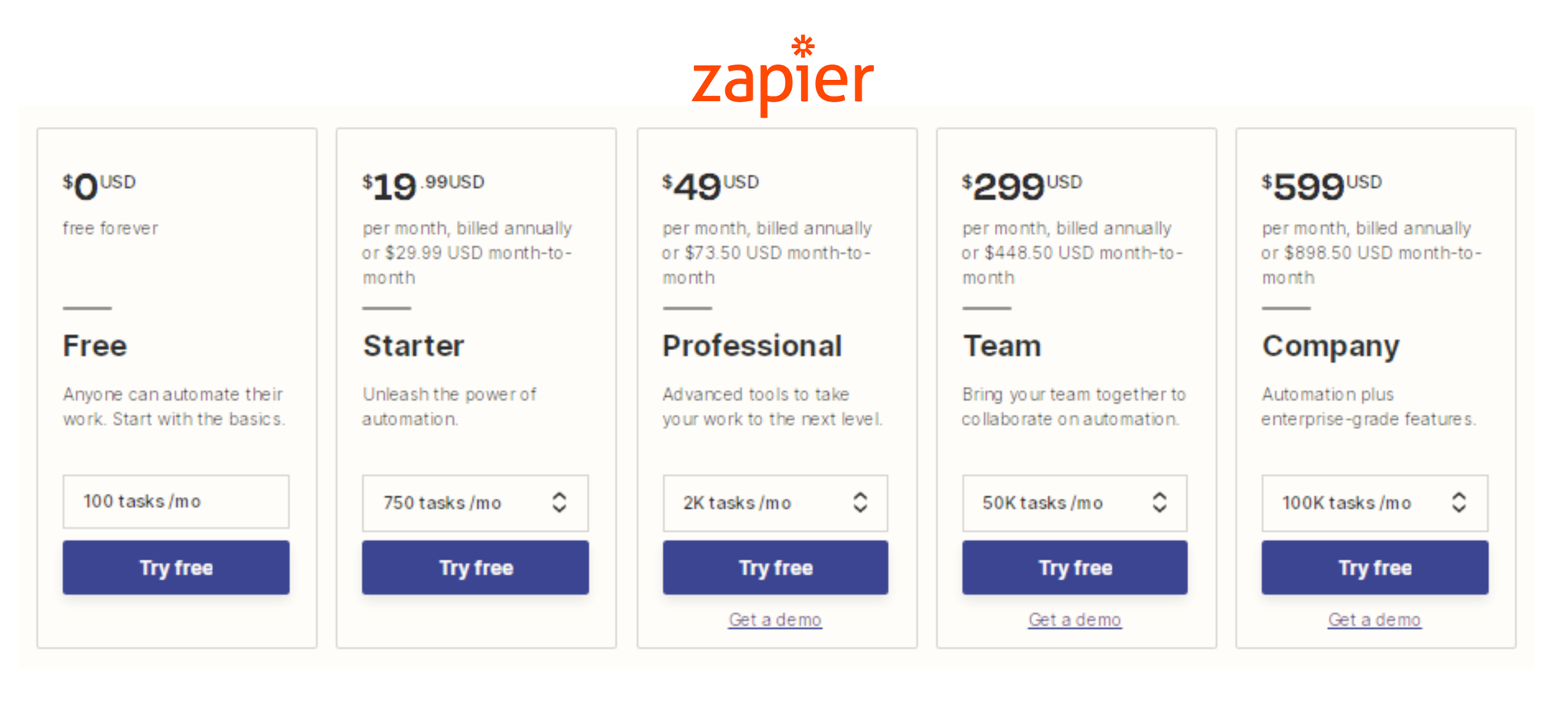

Say you're Zapier. You've gone through steps 1-3 and narrowed options to tiers with usage-based pricing. You'll still need to answer a few more questions before you ship your new pricing model. For example:

- How many tiers do we need?

- What user need does each tier cater to? Starter, Professional usage, Team usage, Company-wide usage, etc.

- How much does each tier cost?

- How will we apply limits to each tier? For example, how many Zapier Apps per tier?

- What features go into each tier? Zapier has highly-differentiated feature sets per tier. As you build your tiers, a lot of research will go into packaging. Aka, finding the right feature, for the right tier.

You can answer these questions with a spreadsheet simulation, where you maximize your margins by experimenting with different tiers, lengths, prices and usage limits. But until these settings aren't grounded in real use cases, you risk alienating customers.

Referring to Monetizing Innovation again:

Product Configuration refers to the decision of which features will be included in a product. Done right, you design a product with the right features for the right segment. Configuration is more Science than Art.

We'll show you how to combine simulations with user understanding. Doing so allows you to reconfigure and innovate on Product, Product Marketing and Brand.

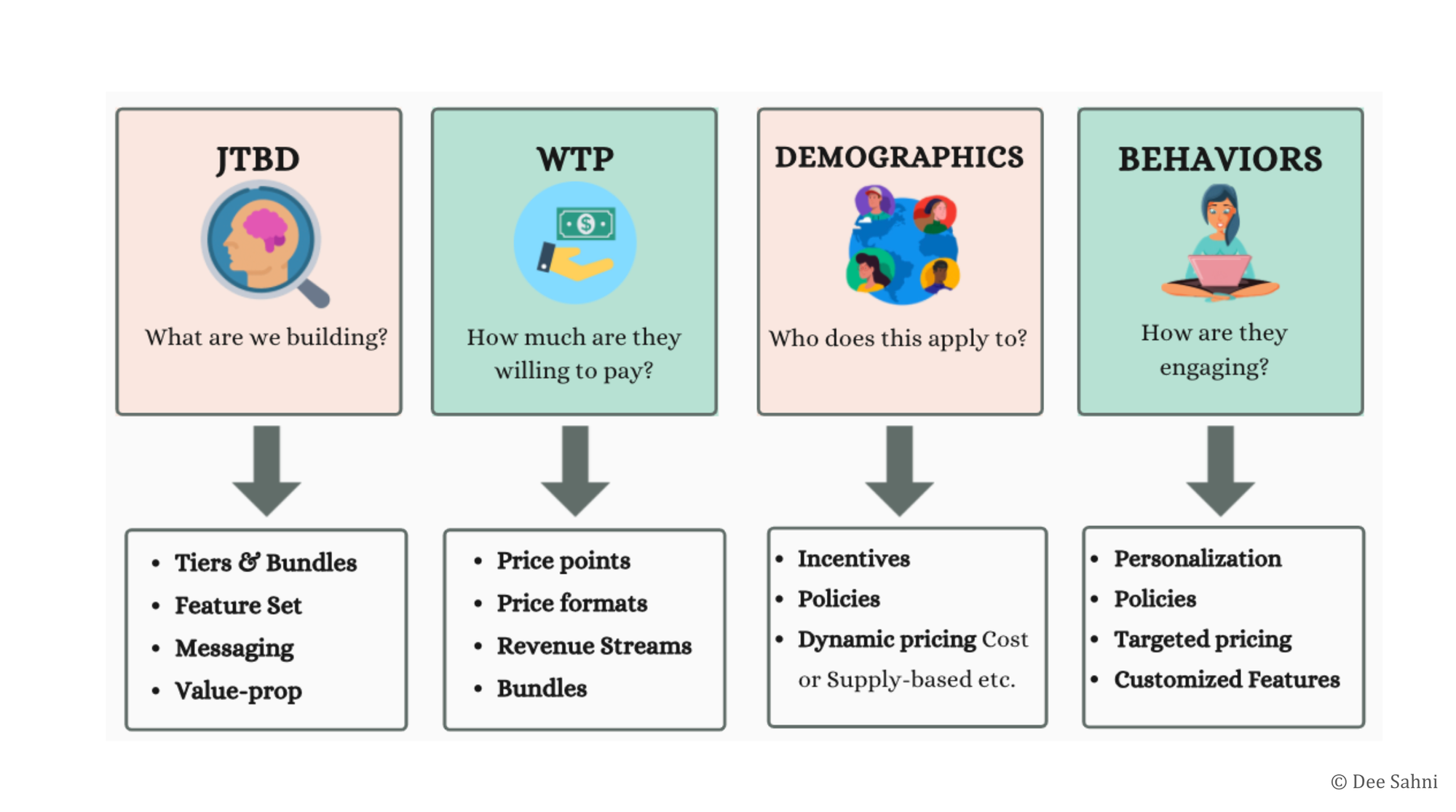

Build customer attributes across 4 buckets.

We'll build customer attributes across four distinct buckets and each bucket will power a different part of your pricing.

- 1. Job to be done and user needs will determine what features you serve and how you create tiers or bundles. JTBD also allows you to message and position to viscerally resonate with customers.

- 2. Willingness to pay will determine sticker price, format and also which services and products are bundled versus charged separately

- 3. Demographics are observable traits available to the seller prior to showing price. This allows you to customize price-to-person. Demographics such as zip code, income, etc. will set incentives, policies and dynamic pricing that either help you align price to costs, or maximize value extracted per segment.

- 4. Behaviors are how customers are engaging with your product. How often do they order, do they return 90% of all orders, do they have exceptionally high consumption as you charge an all-you-can-eat flat rate? You can create incentives, policies, targeted pricing and personalization that will throttle behaviors, change them or create limits.

Which buckets do you need?

Early in your product lifecycle, starting with the first two buckets as essential. Jobs to be done will dictate what to build. Willingness to pay will show you how to price it for your business goals e.g. either high growth or profitability.

As your product gets sophisticated, layer-in Demographics and Behaviors. Customer growth will give you more data on how they use and engage with the product. Behaviors will allow you to build a more tailored product. And demographics will allow you to serve the right product to the right user. Behavior and demographic-sensitive pricing will maximize value created per customer.

Examples of how each customer attribute is used.

We’ll use a few real-world examples to dive deeper into each customer attribute.

1. Jobs-to-be-done and needs. Here are a few of the different JTBD framings for Uber's customers:

- Wants to commute with a black-tie luxury experience —> Uber built a premium tier with luxury cars and drivers, called Uber Black.

- Wants to commute in the cheapest way possible with reasonable wait times —> Built an economy tier, called Uber X

- Wants to commute cheaply, but doesn't want to wait —> Charge a surcharge to prioritize this user

- Wants to commute cost-effectively, but also cares about the environment —> Built an eco-friendly tier, called Uber Green

2. Willingness to pay: This is where you’ll see Uber’s dynamic pricing, depending on demand at that time of day.

3. Demographics: For example, Uber might predict a higher willingness to pay in the 90210 Beverly Hills zip code, personalizing the experience to show the luxury Uber Black car as the first option.

4. User behaviors: For example, Uber could offer subscriptions at a higher price point to customers who frequently request a ride during peak hours.

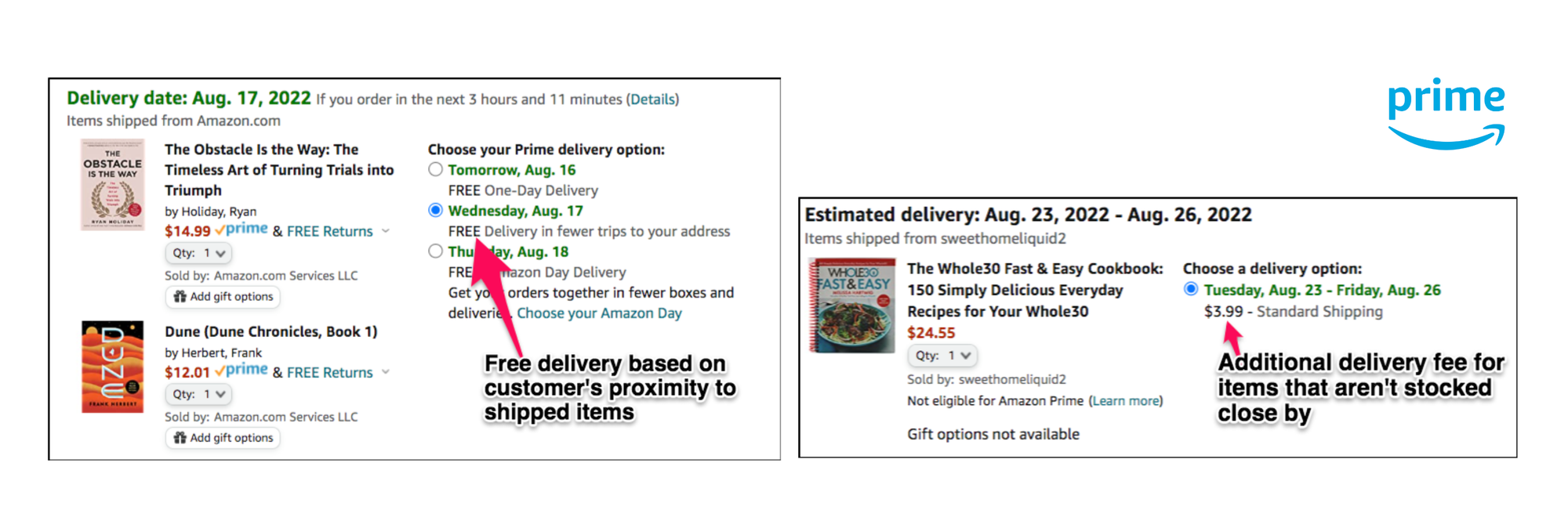

Amazon Prime uses demographic data to protect margins

Amazon's delivery fees and windows are adaptive. They change both fees and delivery windows based on costs and a user's proximity to fulfillment centers.

This helps Amazon both lower costs and also monetize better. Broadening the delivery windows for items that are more expensive to ship allows them to batch orders, use ground shipping, etc.

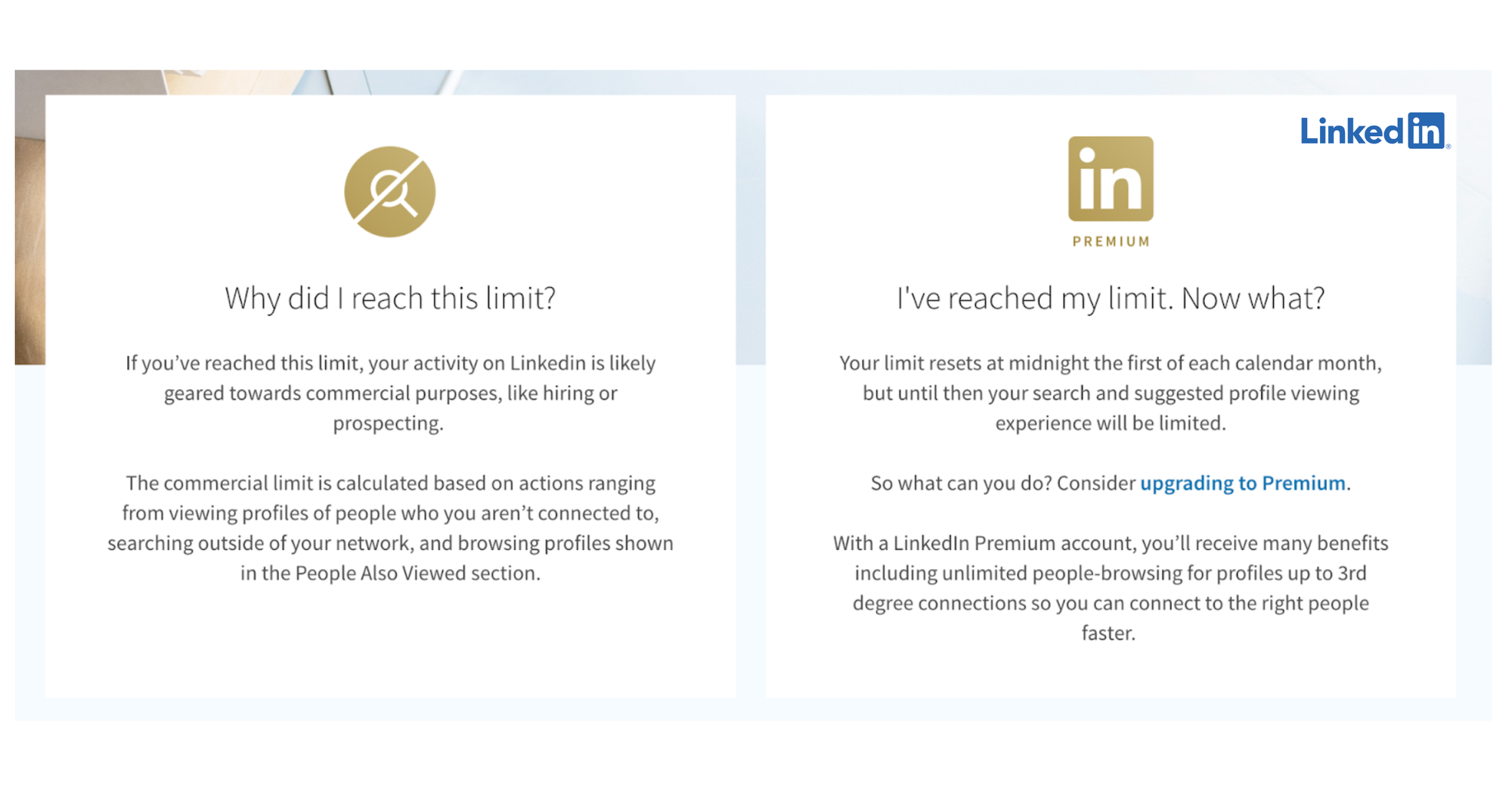

LinkedIn uses behaviors to change usage tiers

LinkedIn monitors the number of searches and profile navigations to limit usage and upgrade users. If you perform enough searches or use the "People also viewed" tab too often, your search capabilities will be blocked until you upgrade.

While behavioral feature gating can create additional business value, it must be used carefully. It can be unclear to the user what the limits are or how they were calculated. A lack of transparency can degrade brand value by coming across as extractive.

The most elegant implementations of behavioral gating are transparent about what exactly their limits are. It’s recommended that you warn users in advance as you're approaching a limit. In the long run, price transparency can have the effect of increasing willingness to pay.

WRAPPING UP: START, BUT DON'T STOP.

We've shared a framework to grow margins (LTV) and unlock new growth (CAC). But improvements to LTV and CAC have a finite shelf life. Pricing isn't a one-and-done exercise. It has to adapt to changing needs and market dynamics.

Your features, rules and prices will evolve. Your core business model itself may change. As your brand matures, you'll experiment with new models and positioning. Like Nike, you may experiment with a build-your-own-sneaker model. Or like Walmart, a subscription model.

Each user cohort will also change in size, impact and growth rate. As your user base grows, you'll build a rich usage data set. This data will inspire more granular models, products and algorithms.

Our framework allows you to stay connected to these changes and stay ahead of the curve — reinventing yourself when the time is right. Along the way, you might even improve your relationship with the finance team and if you’re lucky, snag an invite to their next happy hour.

Special thanks to Stephanie Kwok for her invaluable feedback and direction. Keya Patel, Natalie Rothfels, and Guillaume Torche for lengthy sessions brainstorming and challenging ideas. And Dean Singh and Michael Cummings for their mentorship.

Disclaimer: This piece reflects the views and ideas of the author.