By Meka Asonye

"We just need more sellers."

It's the siren song that's led countless startups toward shipwreck. You've landed your first dozen customers through founder-led sales, proven there's demand, and now your board is pushing for aggressive growth. The math from here seems simple: more sellers + more leads = more deals.

It's tempting, but this equation rarely adds up in the earliest days. But without sales repeatability, every new sales hire just presses the fast forward button your company’s burn rate. (What I mean by repeatability here if you’re not familiar is turning your early wins into a predictable formula: a proven process where X leads reliably convert to Y customers.)

Sam Taylor, who scaled sales at Dropbox, Quip, and Loom, has seen this story play out countless times. “10 closed deals looks amazing on paper,” he told me. “But dig under the hood and you'll find two friendlies, a warm intro from your cap table, and your sister's college roommate with spare budget. That's fine for getting a business off the ground — but it's not repeatability.”

Those early wins can be dangerous — they create an illusion of a working sales motion when you're still running on the fumes of founder hustle and lucky breaks. As both an early-stage investor here at First Round and a former go-to-market leader carrying my own quota back when Stripe was scaling fast, I've seen this movie too many times. Founders confuse their personal founder-led sales chops for a scalable sales process. They hire aggressively, thinking they can clone their founder magic. Six months later, they're staring at a sales team burning through runway with nothing to show for it.

Breaking free from bespoke, founder-led sales is often the make-or-break moment for startups. Repeatability is where true product-market fit begins to reveal itself.

Why does one seemingly perfect prospect ghost you during the sales process, and another one can’t wait to sign the dotted line? How do you evolve from warm intros and founder-led demos to a proper sales engine? That’s what I sat down with a group of experts to find out. In addition to advice from Sam Taylor, here’s who else you’ll hear from:

- Mike Molinet, who founded Branch and scaled the company to over $100M in ARR, and is now back in the trenches doing it all over again with his new company, Thena

- Michael Loiacono has been one of the first 20 startup employees 6 times in his career, most recently at Testlio

- Marta Bralic Kerns, who is the founder and CEO of Pomelo Care and previously led business development and new product initiatives at Flatiron Health

- Peter Kazanjy, the co-founder of Atrium who also previously founded TalentBin, which was acquired by Monster Worldwide. He also authored “Founding Sales,” the startup sales handbook

Let’s dive in.

The repeatability framework: four steps from spiky chaos to well-oiled machine

The allure of the massive TAM — the one you pitched to investors and early employees — makes it tempting to aggressively pursue every opportunity. After all, what better way to validate your market than closing deals across different industries? But the startup graveyard is littered with companies that spread their early limited resources too thin.

“Success comes down to learning to say no to the wrong customers — even when they're waving checkbooks at you,” says Sam Taylor. “Every PLG company gets that magical inbound from a Fortune 50 'innovation' leader. Your eyes light up — JP Morgan wants us! But when you fast forward two years, you've burned countless hours on a sales cycle with absolutely nothing to show for it.”

In our previous installment in the 0-$5M series, we talked all about how to find your ultra-specific ICP. This is where that work becomes extremely critical. Focus isn't just about efficiency — it's the foundation of repeatability.

Step 1: Avoid distraction to find your beachhead

When Sam Taylor joined Loom as the VP of Revenue, he came face-to-face with this exact problem. “One of our challenges with repeatability as a horizontal tool is that we could sell to anybody. And every conversation about how the prospect might use the product is a bit different,” he told me.

Here's the hard truth: You have to place a bet. Out of all those high-intent leads flooding in, pick two — maybe three — personas that matter. That's it. That's your world now.

-Sam Taylor, former VP of Revenue at Loom

His key question cuts to the heart of it: If you could sell to everyone, who do you deliberately choose not to serve (at least right now)? Here's why going smaller with ruthless focus actually means growing faster:

- Credibility snowballs: With a narrower focus, you can develop a greater depth of expertise about your buyers and their pain points. This credibility shows up in every touchpoint — from your first cold email to the final demo.

- Network effects activate: Word-of-mouth is an incredibly powerful tool. When you focus on an initial wedge, referrals and introductions flow more easily. Your buyers probably know each other — use that.

- Messaging sharpens: Avoid the ultra-generic value props. Whether it’s content, digital marketing, case studies or events, the messaging can be shaped around a specific buyer persona.

- Experiments accelerate: A humming sales process is all about nailing the right touchpoint at the right moment. Specificity means you can focus on quick A/B tests (like testing your outbound messaging) and land on what works in weeks, not months.

Step 2: Define the funnel stages for a happy customer journey

If I asked you exactly how your last deal closed, could you walk me through each and every step?

For most early-stage founders I sit down with, the answer is no. It feels normal in the early days — every deal is its own unpredictable adventure, every close a unique story. But this chaos masks a dangerous truth: if you can't map your buyer's journey now, you'll never scale beyond founder-led sales.

Hidden in your early deals is the blueprint for sales repeatability. But you need to stop chasing the next deal long enough to find it.

Try to map your buyer's journey through four stages:

- Awareness: How do perfect prospects first discover you — and how do you make it happen more?

- Interest: What turns a casual look into genuine curiosity about your product?

- Evaluation: How do tire-kickers become serious buyers?

- Conversion: What's the final push that turns maybes into yes?

Yes, your early deals probably zigzagged through these stages. That's fine — but now it's time to trace a straighter line through that chaos.

This is where Sam Taylor's post-mortem process becomes crucial to turn your sales process from art to science. "Every win is a lesson," he says. "Reverse engineer it. What actually moved the deal forward? Which elements mattered, and which were just noise?"

Create a sales recipe where you know that if you follow the steps, you can bake cakes.

-Sam Taylor, former VP of Revenue at Loom

Your recipe won't look exactly like anyone else’s. It can’t. Your product, your market, and your buyers are unique. But documenting your "happy customer journey" transforms random wins into repeatable success.

"Every pitch taught us something new," Pomelo Care's Marta Bralic Kerns told me. She turned each early deal into a learning opportunity, asking six critical questions:

- Which messages hit home?

- Who are the essential players in the room?

- What's the perfect meeting sequence?

- How do we maintain momentum between touchpoints?

- Which deal terms matter most?

- Where do we draw hard lines?

Step 3: The numbers don’t lie — establish funnel metrics

But just because your process is a bit messy and a work in progress doesn’t mean you should throw metrics completely out the window. “Be really clear on your funnel conversion rates — they will tell you at least 50% of what you need to know. They reveal exactly where your sales process is breaking,” Testlio’s Michael Loiacono told me.

Finding sales repeatability is about identifying what’s broken (or the most broken) and fixing it as quickly as possible.

-Michael Loiacono, VP of Global Sales at Testlio

Here are some simple metrics to track to get you started:

- Meetings set: The number of first meetings you book.

- Meetings Executed: The number of first meetings that actually happened. (These can also be called “opportunities” because you should open an opportunity for every meeting you execute.)

- Opportunities Qualified: The number of opportunities that fulfill your qualification criteria (i.e. align with your ICP).

- Optional: Trial or Pilot Kickoff: If you have a trial period or pilot as part of your sales funnel, include the number in that stage.

- Closed-Won: The number of deals that have been won.

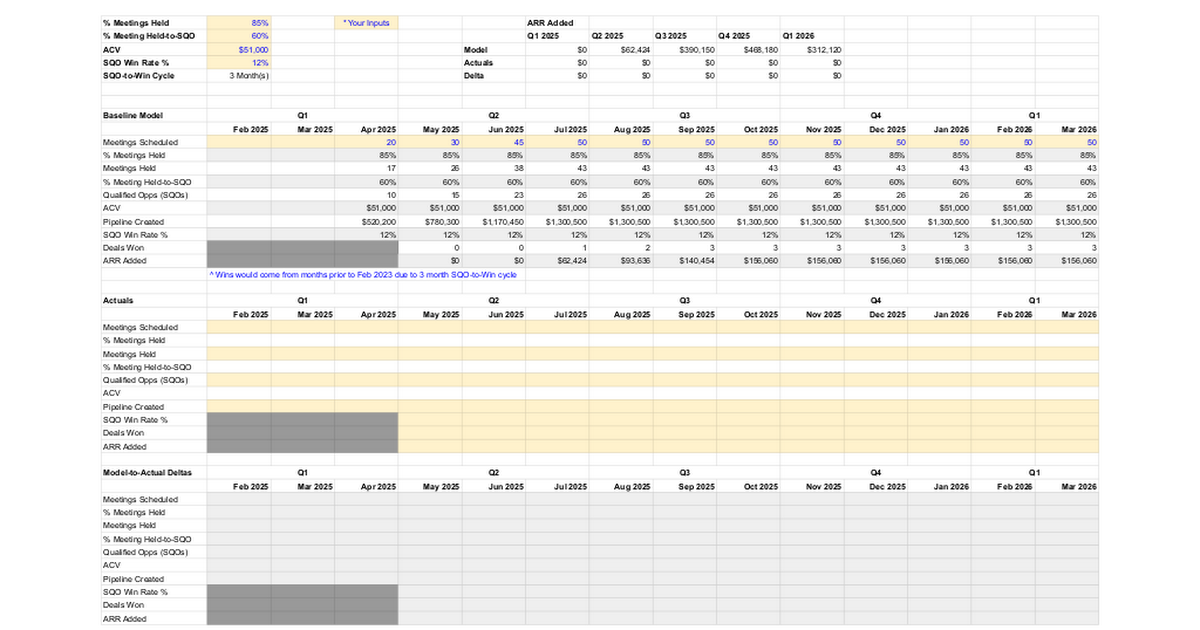

Once you’re clear on the funnel stage definitions, you can start to build out your forecast, which takes into account your current (or expected) conversion rates across each stage of the funnel, your average sales cycle and your average contract value. It’s the closest thing to a source of truth for how many first meetings you need each month to hit your ambitious revenue goals.

First Round’s VP of Founder Success & GTM, Emery Rosansky, generously shared her own waterfall forecast template here to help jump start your efforts.

Step 4: Translate the founder’s magic

Founders possess a hidden sales superpower (even the ones who swear they’re “not natural salespeople”). They can close deals through raw conviction in their product and unbridled passion about the space.

But this intrinsic founder magic makes it all the more difficult to unlock sales repeatability, because there’s no scalable sales motion if every single deal relies on the founder pulling a rabbit out of their hat.

Sam Taylor has cracked this code before. “Here's the hard part about following a founder as an early sales hire: You can't just parrot their words and expect to win deals,” he told me. “The founder has built-in credibility that no sales leader can match. You need something different."

His early work as a hire at Dropbox (as the first enterprise sales rep) and Quip (as the first sales leader) was to act as a Rosetta Stone. “I try to decode what worked well to get those early deals done so we don’t have to rely on the founder to deliver that message. What we translate may not be perfect, but it’s going to get us pretty darn far in articulating that vision and the why behind our offerings,” Taylor says.

Among the trickiest transitions in building repeatability: learning when to step aside. Mike Molinet has navigated this shift twice — first at Branch, now at Thena. “At Branch, I couldn't let go of sales,” he admits. “I thought nobody could tell our story like I could so I just put in the extra hours to make it happen. But then you get stuck in the weeds, handling basic tasks that others could do, while the bigger opportunities for the business slip away. You have to learn to let go, even when you know someone else won't do it exactly your way.”

But letting go doesn't mean checking out entirely. “Use the founder card strategically,” Molinet says. “When I have a personal connection to a CRO, I take that call. But org mapping, building pitch decks and cold outreach is better handed off.”

His litmus test is ridiculously simple:

As a founder, ask yourself: Am I uniquely positioned to do this or would someone else basically have the same outcome?

-Mike Molinet, founder of Branch and Thena

Three repeatability killers (and how to avoid them)

Even with a clearer sales process, most startups still stumble on execution. I’ve noticed three critical mistakes that separate the companies that scale from those that stall.

Mistake #1: The headcount trap

We touched on this already, but it’s well worth putting a finer point on because it’s a mistake I see all the time. Simply adding more salespeople will not drive growth — it might just do the opposite, because salespeople don’t come cheap.

“Some investors push a spreadsheet onto their founders: ‘In order to hit growth targets next year, you need $X quota in the field, so go hire 10 more reps.’ And that’s such a backwards way to do things,” Michael Loiacono told me. “You want capital efficiency, and that comes from having reps who are converting at a higher rate.’”

I don’t consider hiring another salesperson until my reps are crying uncle because they don’t have time to go talk to leads.

-Michael Loiacono, VP of Global Sales at Testlio

If your salespeople aren’t trying to hot potato their leads, don’t rush to hire, invest in filling up that pipeline. Pour that budget into demand gen, marketing, and growth. A small, overwhelmed sales team beats a large, idle one every time.

“When your reps are swimming in leads, the entire company feels that momentum. They’re getting a ton of at-bats to see market patterns faster and adapt quicker — not sitting around doing cold-calling because you hired ahead of demand.”

Mistake #2: The “It's not you, it's me” problem

Deals start strong but fizzle. Initial excitement evaporates. What happened?

Peter Kazanjy, Atrium co-founder and author of Founding Sales, has mapped out how to pinpoint the true issue. “Start with the problem,” Kazanjy told my partner, Brett Berson, on First Round’s In Depth podcast. “If you can't convince prospects they have the problem you solve, that's an ICP issue — you're talking to the wrong people. But if they clearly feel the pain, recognize it in discovery calls, and still don't buy? That's not an ICP problem, that's a persuasion problem.”

If you’re getting people into your funnel but your win rates are problematic, that indicates that you have a narrative problem.

-Peter Kazanjy, co-founder of Atrium and author of “Founding Sales”

At a bare minimum, he says, you should structure your sales deck to correspond to the various steps in your sales narrative:

- What is the problem you’re solving?

- Who has it?

- What are the associated costs of the problem?

- What are the existing solutions and their shortfalls?

- What has changed to enable a new solution?

- How does it work?

- What is the qualitative/quantitative proof that yours is a superior solution?

- How much does it cost?

Here’s how he sketched out each one for TalentBin, a recruiting product he co-founded and eventually exited to Monster Worldwide:

- What’s the problem you’re solving? “TalentBin's problem statement was: ‘Technical recruiting is hard. It's hard to find software engineering talent with the relevant skills that people need to hire for, and even if you can find them, getting in contact with them is tough. And once you've found and contacted the relevant talent, keeping on top of all those conversations can be a huge time suck fraught with dropped balls, all leading to slower hire times and raised cost of hire.’”

- Who has it? Our direct audience was the recruiters responsible for filling open positions and their managers.

- What’s the cost of the problem? “A winning argument for TalentBin was that recruiters have no time to waste. Hot candidates come on the market and are snapped up in a heartbeat. Slow processes mean lost revenue. Manual work means people can get lost in the shuffle, damaging valuable relationships in a relationship-driven business. Seeing these consequences spelled out so clearly moved a lot of customers into the 'Yes' column.”

- What else is out there? “For TalentBin, existing solutions included LinkedIn. Knowing this and what the experience was like gave us an opening to show how TalentBin would surface 5x as many solid candidates as LinkedIn Recruiter.”

- What’s changed? “Your narrative needs to show that you have pushed things forward, progress has been made, and new capabilities have been introduced to the market. For instance, LinkedIn represented a massive leap for recruiters. It allows them to tap into a huge database of potential employees far bigger than any collection of resumes they could build organically. The change was clear.”

- How does it work? “The most critical thing is knowing how to easily explain this in an understandable way to your prospect. I recommend using contrast and comparison with solutions you know they already understand. With this in mind, we could explain that TalentBin is a resume database, or even like LinkedIn search, but that it takes advantage of all professional activity that candidates engage in online to help recruiters discover them, even if they aren't actively looking for new jobs.”

- Proof: “TalentBin's key metrics were all about cost per hire, quality of hire and time to fill a role.”

Mistake #3: Optimizing when you should be maximizing

I find founders are commonly hung up on how to optimize their sales comp. But when you’re in the 0-1 phase, it’s frankly way too early to be having that conversation. Even back when I was at Stripe as one of the first AEs, in the beginning we had a 10-person sales team with no variable comp. Sales compensation plans aren’t nearly as important as you think they are in the early days.

That’s why my general advice is to hold off on commission-based comp models for early sales hires until you have reasonable certainty they can hit that quota target. Start simple with a model that includes a base salary, equity and potentially a discretionary bonus. Then give the sales rep a hypothetical target and check in throughout the quarter to see if that target makes sense. If you’re 10% to target or 500% to target, you know your math needs work.

“At scale, optimization matters,” Thena’s Mike Molinet told me. “Saving 1% on quota per salesperson can mean $500K in annual savings — that’s a material benefit. But in the beginning, don’t worry about optimization. You should be asking: How do we get more customers, faster? How do we maximize ARR? Who cares if you overpay a bit on commission — that means deals are closing.”

I see way too many early-stage founders (especially first-time founders) focus on optimization instead of maximization. Growth solves most things, so focus on your speed to $5M.

-Mike Molinet, co-founder of Branch and Thena

Everyone celebrates the obvious milestones — your first sales hire, that game-changing enterprise deal. But after working with so many founders in this messy 0-1 phase, I've learned the real turning point is subtler: It's when you stop seeing each sale as its own epic adventure and start to recognize the same story beats playing out again and again, deal after deal.

So when leads ghost you, when prospects push back on price, when you completely botch a demo, try to see each set back as an opportunity to find those common threads and learn something about the machine you're building.

Because perfect doesn’t exist in early-stage sales, but better does.

You can catch future pieces in the 0-$5M series by subscribing to The Review or following me on X @BigMekaStyle.