Today on the Review, we’re excited to launch a new series all about the messy yet exhilarating phase of going from $0 to $5M in revenue. First Round Partner Meka Asonye is leading the charge here, and this is a topic he’s spent tons of time wrestling with. He explains more about what sparked the idea for this series in the note below.

Think of the framed first dollar bill you see behind the counter at your local mom-and-pop shop or restaurant, an iconic symbol of someone bringing an idea to life. For founders building B2B companies, getting to that first $5 million in ARR represents a similar milestone — albeit with a few more zeroes behind it.

But something too many gloss over, in my view, is that the path to that first few million starts long before the first dollar comes in the proverbial door. Too often, technical founders furiously build before coming up for air, telling themselves “We'll figure out the commercial stuff later.” The pressure to move quickly on the product front can cause founders to skip the critical early work of laying strong commercial foundations.

This temptation to focus solely on building will likely only grow more pronounced in an era where AI makes it possible to ship faster than ever. Founders can now go from idea to launch in record time. And we’ve all seen the headlines about AI companies that have reportedly sprinted to their first several million in revenue in absurdly condensed timeframes, with social posts touting growth curves that resemble almost vertical lines.

But the jury is still out on how sustainable these growth engines will be — a fast start off the blocks doesn't guarantee staying power, and we’ve already seen just how quickly competitors can crop up and moats can dissolve. What looked like near-instant product-market fit might later reveal itself as temporary fervor, with high churn rates lurking around the corner. When it comes time for renewal, the question is: Did you truly become part of the workflow, or were you just a shiny object worth experimenting with?

Reaching extreme PMF and unlocking lasting commercial success — the kind that compounds year after year — remains incredibly challenging. That’s why here at First Round we get particularly excited to team up with founders who’ve gone unreasonably deep — not just in lines of code, but in excavating many layers into the market, their customers, and their potential path to building an enduring business.

It’s never too early to think about the commercial side of your business — getting to your first few million starts long before the first check clears. It begins by choosing the right market, the questions you ask in customer discovery interviews, and the ICP you land on.

The real question isn’t just how fast you can sprint to your first few million in ARR. It’s whether you’re building a GTM engine that can sustain the growth, even after the hype dies down. In my experience (and what I tell every founder I meet with), neglect of the commercial side of the ledger is a recipe for pain down the road. Put simply, this isn’t “Field of Dreams,” and the “build it and they’ll come” strategy usually doesn’t pan out in the long run.

You’ll have to forgive the clunky baseball metaphors — my non-linear path to becoming a partner at First Round started out in the “Moneyball” world of working on player development and baseball operations for the Cleveland Indians. But it was my time at Stripe as one of the first account executives that would more directly shape my perspective on what it takes to build enduring companies.

As Stripe scaled from 250 to 2,000 people and began moving upmarket to land enterprise logos, I headed up our efforts to 10x our Startup/SMBs business. This meant everything from launching outbound sales and building a customer success function to developing distribution partnerships and standing up new offices. Later, as VP of Sales and Services at Mixpanel, I led a 100-person global team, owning the customer lifecycle from first website visit to renewal.

These experiences showed me that early commercial choices, even ones that feel incidental, compound over time — both positively and negatively. Now as an investor at First Round, I partner with founders further upstream at the very beginning of their journeys — often pre-revenue — tackling the full range of early-stage challenges: What should we build first? Who's the right customer? How do we price this? When do we start hiring?

These are questions that every founder must grapple with, whether they’re building straight down the fairway B2B SaaS like automating startup compliance, literal rocket scientists building better satellites or creating more effective 911 tech for first responders (and I’m fortunate enough to be partnering with each of these builders). The early decisions can ripple through a company’s entire growth trajectory, far beyond those first few customers and the first few million.

Working closely on these very early founders and hunting for good resources to recommend specifically for the journey from 0 to $5M, what I noticed is that most early GTM advice floating around out there misses the mark in one of two ways: It’s either too broad, doling out platitudes that apply to everybody but help nobody, or too specific, focusing on an already-successful company’s path to millions in ARR, which may not be applicable for most other startups. There's surprisingly little tactical guidance that hits the sweet spot in between.

My goal with this series is to attempt to fill that gap (and it’s heavily inspired by the work my friend and fellow First Round Partner, Todd Jackson, has undertaken these past few years by sitting down with founders of top startups like Airtable, Vanta, Gong and Replit to diagnose precisely how they found their paths to product-market fit).

I’m not aiming to present some kind of universal formula for early GTM efforts — those are few and far between when it comes to startups. Instead, I hope to surface concrete patterns and practical frameworks that still-very-early-days founders can apply right away, tweaking to suit their unique circumstances.

That’s why we’re taking a slightly different format here. Instead of deep-dive profiles on how one company cracked the code on GTM, in each installment in the series, you’ll hear from a chorus of different voices to provide a wider range of perspectives — from technical founders who had to learn sales from scratch to early GTM hires who helped scale today's iconic companies (and clean up the messes). Some of these folks are well past that $5M milestone, others are currently working towards it now.

My goal is to unearth the hard-won lessons that founders and first sales hires learn (often painfully) during the 0 to first few millions process but tuck away in the corners of their brains. We'll examine not just what worked, but why it worked, diving deep into the nitty-gritty details that often get glossed over in startup lore, like how to approach those first customer calls (do you sell right away or take a softer approach? When should you demo?), warning signs that PLG isn’t a good fit for your buyer, when to consider moving upmarket and trying your hand at selling to enterprise, and what are the signals that it’s time to set aside founder-led sales and hire your first salesperson.

I hope you’ll follow along (and send in any ideas for future topics or guests to @BigMekaStyle on X).

With that, let’s dive into the first article in the series, all about how founders can overcome their fear of the “sales boogeyman” and embrace founder-led sales.

“My biggest fear when I decided to start a company was that I would have to do sales,” Marta Bralic Kerns, founder and CEO of Pomelo Care (a virtual support platform for pregnancy and newborn care), recently told me.

As someone who's spent a decade in go-to-market roles before becoming an investor, I’m always surprised to hear this sentiment that sales is intimidating, but it comes up constantly in my conversations with founders, especially technical ones.

There's that initial burst of energy when an "imagine if" moves from notebook scribbles into building a company in order to try bringing it to life. But then the shadows creep in as founders confront a daunting reality: Most have virtually no sales experience. They're armed with only an untested pitch, a work-in-progress product, and zero process for moving prospects through a pipeline.

Doing sales for the first time is hard. Doing sales for the first time at a startup is even harder.

The temptation to delay this discomfort is significant. There are typically two ways I see folks try to dodge the founder-led sales bullet.

Some try to delay for as long as possible, tinkering with the product. Maybe if I build something so special, the product will just sell itself, they think to themselves as they pour another cup of coffee and code into the wee hours. This is an alluring escape hatch for founders eyeing a product-led growth model. As Alexa Grabell, founder and CEO of Pocus (an AI-powered platform for account research and prospecting) told me: “A lot of people, especially those selling PLG products, think to themselves, ‘I don’t want to do sales, the product will sell itself.’ And that just creates more of this mentality that sales is a boogeyman to avoid.”

By the time these folks put down the keyboard, they often realize they’re many thousands of lines of code deep into a product that’s miles away from unlocking product-market fit. And there’s a wide gulf between a prospect thinking your idea is cool and actually making room for you in their budget.

The other move I see is founders trying to hot-potato sales to someone else entirely. I’m not a salesperson, so the product will be much more successful if I bring someone else on to pitch, they rationalize. But what I try to help founders see is that farming this work out entirely to an early sales hire sandbags the critical early work of defining your ICP, prioritizing must-have features in your product roadmap, and identifying potential design partners.

What founders lack in savvy salesmanship, they make up for with an unfair advantage that no hired gun can match. “Unlike salespeople, founders have a right to just ask whatever they want and jam on an industry,” Alexa Grabell told me. And I couldn’t agree with her more.

There’s a difference in expertise that a founder brings that a seller simply can’t. Founders can sell by brute force because you’re so passionate about your vision and the product.

-Alexa Grabell, founder & CEO of Pocus

But despite these aces in hand, far too often I’ve seen founders who hesitate to go all in. So I tapped a group of founders and sales leaders who are where you want to be. They unpack their biggest lessons on founder-led sales with the hopes that you can pocket advice from folks a few steps ahead of you before fumbling through those first sales conversations.

In addition to Grabell and Bralic Kerns, I got to talk shop with some truly legendary GTM leaders — folks who've either done founder-led sales themselves or played a big role in building now-iconic companies:

- Sam Taylor, who as Dropbox's first enterprise sales rep helped the company crack the code on moving upmarket before going on to lead sales at Quip and help build Loom's revenue engine.

- Mike Molinet, who not only did founder-led sales to get Branch off the ground to over $100M in ARR, but is now back in the trenches doing it all over again with his new company, Thena

- Eric Lasker, who started as one of the first sales hires at Stripe — back when there was no brand and no playbook — and is now leading the commercial charge at Varda Space as CRO

Each one shared pure gold (with a sprinkling of tough love) — and what really struck me is how consistent their advice was, even though they've sold products ranging from developer tools to commercializing AI to enterprise security and even spaceship reentry capsules.

These aren't your typical LinkedIn bro tips about "crushing your number." I asked founders and first sellers exactly what moves they used to get their first customers. Not the sanitized version. Not the standard sales playbook. The actual tactics that worked (and some wrong turns they wish they could have avoided).

Now, enough preamble from me. Let’s dive into their specific advice on everything from crafting a cold outbound email to A/B testing your sales calls to deleting product jargon from your pitch.

A Wake-Up Call: Stop Fearing the Sales Boogeyman

Sam Taylor’s sales pedigree is epic. He was the very first enterprise sales rep at Dropbox, after which he joined Quip as its first sales leader and later Loom as the VP of Revenue. As the first salesperson in the door, he’s used to a lot of the “I could never do what you do” remarks from folks who proclaim they’re “just not natural sellers.”

He doesn’t mince words here, especially when it comes to the founders he advises: “I call bullshit on it,” he told me bluntly. “You’ve raised money, you’ve gotten jobs before. You’ve found a way to sell yourself or sell the vision of what you’re doing,” says Taylor.

He shares his pep talk to yank folks out of the underdog mindset. “Sales does not mean ‘I send you a DocuSign and you pay me money,’” he says. “Most of the questions that you're probably going to ask Mr. CTO in your customer development conversations early on — that’s sales. You're uncovering pain, you're getting an understanding of the buyer, you're hopefully building a lot of rapport with these folks. That’s the hardest part, and you’re already doing it.”

People discount that they actually have a sales superpower and they’ve had a lot of at-bats that they just don’t think of as being sales experience.

-Sam Taylor, former VP of Revenue at Loom

And in fact, that lack of formal sales training might give you a leg up, says Mike Molinet, the founder of Branch and Thena. “There’s some advantage to having a certain level of naïveté where you don't know certain aspects of an industry, and because of that you believe anything is possible,” he told me. “That can actually push you to do more versus being saddled with the way things have historically been done.”

Still feeling sales skittish? I love this small tip from my buddy Eric Lasker (who went from being one of my early colleagues at Stripe to becoming CRO of Varda Space): Try starting with some training wheels. “Go ask your founder friend to ride shotgun with their sales leader, even on lower-value calls, to see up close what a well-run sales call looks like,” he suggests.

With that dose of tough love and a new sales-curious mindset, let’s unpack the specific tactics for getting over the cold start of founder-led sales. As with all startup advice, there’s no shortcut to going from 0-1, so your mileage may vary, particularly with some of these tips that are a bit more counterintuitive or unexpected. But our goal is to deliver specific advice pulled directly from the playbooks of other founders and first sales hires, especially if it breaks the mold.

Tactic 1: Cast out for the big fish early

Some founders may be inclined to fish for smaller goldfish in the beginning, afraid to waste an intro to a whale when the pitch is still shabby and not quite ready for primetime. But when embarking on her first conversations for what would become Pomelo Care (a virtual maternity care program), Marta Bralic Kerns started at the top. “The first conversation I had before even raising our seed round was with a Chief Medical Officer of one of the largest payers in the country,” she told me.

Don’t be afraid to go right to the buyer, even if you have nothing to sell. “As long as you’re not treating it as a direct sales call, you’re unlikely to burn your shot completely. People like to talk about their expertise,” says Bralic Kerns. “It wasn’t until we had live partnerships and customers that we started approaching sales calls more directly.”

Here’s exactly how she structured these calls in the earliest days:

- Framed it as an expert interview to understand how they think about maternity care

- Kept first conversations extremely high-level, focused on their perspective on the market

- Asked who else in their organization might be interested in sharing their expertise

- Always closed by asking if she could follow up in a few months once they had built more

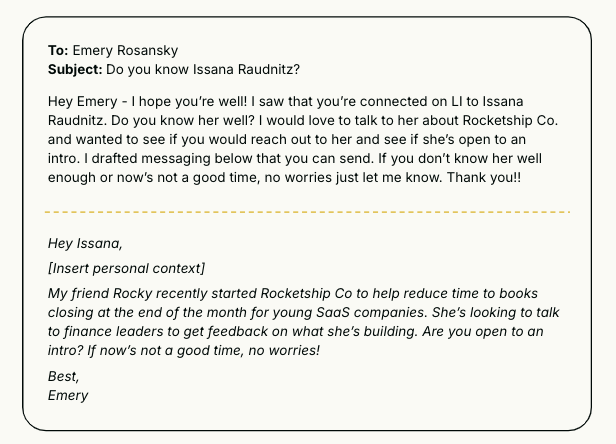

To get face time with your big fish, warm intros can help crack open the door. “95% of the calls we got were through warm intros from our investors, angels, and folks in our personal network,” she says. But as First Round’s own VP of GTM, Emery Rosansky, tells the founders she partners with: make it as easy as possible for the person to help you. Here’s an example she shares with founders who want to leverage their network:

Warm up your cold outbound by a few degrees

But beware of tipping the scales by relying too heavily on warm intros (this is something I stress to all founders). Sure, loose connections are more likely to take the meeting, but they're also more likely to give you polite but ultimately unhelpful feedback. You need some amount of cold outreach to get that "your baby is ugly" kind of unvarnished truth about your product and pitch.

If you’re willing to brave the cold for a stronger signal of interest, here are some bits of advice for crafting an email that doesn’t end up in the trash folder:

- Keep it short. After running tons of analysis, Emery Rosansky has found that shorter is in fact sweeter. Snappy subject lines should be under 6 words (yes, really!) and the email itself should stay under 100 words tops. And make sure your CTA is simple and clear.

- Find your personalization angle. “Cold outbound is hard, and people are sick of it. So look for any opportunity to deliver a more personalized message. Find people who attended your university, or worked at a previous company with you, or who share an investor with you. Reach out to folks who looked at your pricing page. These are some of the signals that I looked at when I was doing my own outbounding,” says Alexa Grabell.

- Founder-to-founder sales. “Parker Conrad used this strategy with both Zenefits and Rippling, ‘Here’s a problem I faced as a founder, if you’re also suffering from the same thing as you’re growing, check out Zenefits,’” says Mike Molinet.

- Conferences. “People are much more willing to meet with you if they are already at a work-related event. I attended all the healthcare payer-specific conferences in person and would send outreach to people who would also be attending, and I got a big uptick in responses,” says Marta Bralic Kerns.

Resist the urge in this first email to go on and on about how wonderful your product is — stick to striking a chord with the problem you aim to solve.

The tactics later on will matter in terms of actually closing the deal, but the emotion will get you in the door.

-Mike Molinet, co-founder of Thena and Branch

Tactic 2: Take all of the calls (and A/B test constantly)

Another mistake I see a lot of founders make in the early sales days is narrowing their approach quite quickly. My advice here? Cast a wide net and don’t be too picky. You have to talk to a lot of different types of people to start forming an educated guess about your ICP.

“My mentality was always to take the meeting and maybe I’ll be surprised,” Marta Bralic Kerns told me. When doing early founder-led sales for Pomelo Care, she spoke to a wide variety of folks across the healthcare spectrum. She would categorize each contact as either a self-insured employer (employers paying for their employees’ and dependants’ care), a fully-insured commercial payer (an insurance company paying for a group of employers’ healthcare costs) or a Medicaid payer (government pays the premiums).

In fact, she took founder-led sales so seriously that when she went on maternity leave after the birth of her child, she told the rest of the team not to bother her unless it was for a sales call — at that point it was only about one call a week. “I realized that sales traction was picking up because I kept needing my husband to take care of the baby so I could be running calls,” says Bralic Kerns.

Alexa Grabell embraced her new founder's optimism in the early innings of Pocus. “I’m deeply curious. So instead of thinking about how daunting it is to go sell, I took a lot of initial meetings from the perspective of understanding how their business operates and figuring out where we can help. I approached with a desire to learn how I can make the person on the other end of the call’s life better,” she told me.

One fun tidbit from the Pocus story — Grabell even began connecting folks she was talking to with each other, with no end game for her own product. “I would be on a call with someone and say, ‘Oh I should introduce you to this other CRO and you can learn from each other,” she says. This completely organic effort would later turn into Pocus’s 10x GTM community.

Grabell’s own journey to fully embrace founder-led sales came from a snippet of advice from Merge founder Shensi Ding. “I remember having a huge unlock when Shensi told me she was the top SDR at Merge in the early days,” says Grabell.

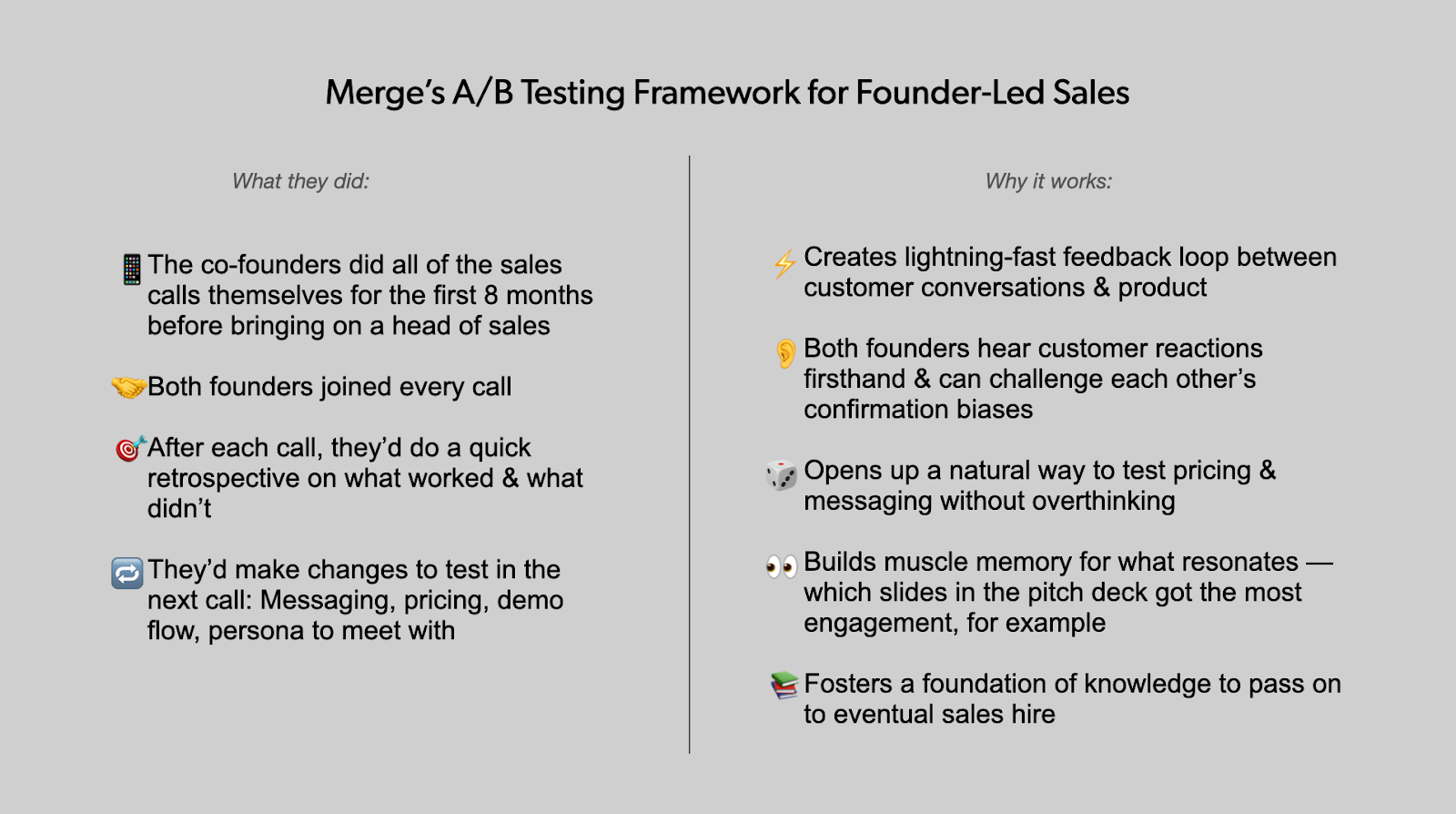

First Round Partner Todd Jackson actually got the chance to sit down with Ding for the full story of how she and co-founder Gil Feig found Merge’s product-market fit. What I love about Merge's story is that they didn't let their early product-led growth success become an excuse to avoid sales. Sure, they had a free tier that brought in 1,000 sign-ups in the first few months purely through inbound. But Shensi and Gil still worked the phones constantly.

Here’s how Shensi remembers that time: “For probably 4-5 months, from 10 am to when we left the office late at night, all Gil and I did was sales meetings, booked back-to-back all over the world,” she told us. “When you do founder-led sales you’re not just learning how to sell your product, you’re learning how to tell a story. This is essential to sell the vision to investors and candidates you’re trying to hire.”

Founder-led selling creates a tighter feedback loop that makes your product better.

-Shensi Ding, co-founder of Merge

The Merge founders A/B tested everything — messaging, demos, personas, pricing. Here’s how they constantly tinkered with their sales formula:

There was one simple learning from Merge’s story that stuck out to me as an unlock that only comes from picking up the phone lots of times: “We found that talking to certain personas didn’t get us closer to a sale. Meeting with an IC engineer or post-sales folks didn’t work — we needed to meet with someone with greater buying power, like a head of product or a head of engineering,” Ding told us.

Tactic 3: Embrace ego death

Now, here's where a lot of founders tend to trip up. You've finally landed that coveted spot on a prospect's calendar. You've spent months building. You're excited to show off your product — and you immediately dive into demoing features.

But especially in these early meetings, leading with curiosity is paramount. “You don’t want to be a solution hunting for a problem. You want to intimately understand the problem,” says Molinet. “Be very careful about building awesome tech that nobody wants to buy.”

A lot of people new to sales are like, “I built this thing, let’s go find people who have a problem that we can give this thing to.” That’s like saying, “I invented this medicine, let’s go see if people are sick with this ailment.”

-Mike Molinet, cofounder of Thena and Branch

He borrows advice from the late legendary sales trainer Skip Miller (I’m also a massive fan of his books “Selling Above and Below the Line” and “Proactive Selling”): “Don’t talk about the dog.” In other words, the more you woof and bark about your product, the less chance you have at a sale. “People want to approach these calls like, ‘Hey, I’m Mike, I’m the co-founder of Thena, Thena does X.’ But it’s not about you, it’s not about the dog,” says Molinet.

Alexa Grabell likened it more to armchair therapist: “I like to keep it high level to let people just complain about what they’re struggling with in the business. What’s keeping you up at night? And then in the next call, we can get a click deeper into what tools they use, their tech stack, their budget, and their buying process. But in the beginning, I just want to start associating myself with the top two or three priorities they have.”

As I’ve found in my own sales career, the best sales calls are the ones where you as the seller don’t talk much at all. “I can easily spend an hour just asking people questions before even talking about my product,” Molinet told me. “That’s how you start to establish patterns that can help you pivot into creating something that people will buy, not necessarily what’s cool.”

People care about themselves — are you solving my problem or not? They don’t care about what you do and who you are.

-Mike Molinet, cofounder of Thena and Branch

By focusing on excavating the problem, not just spouting off your solution, you avoid the happy ears conundrum — where you’re just looking for the tiny hints that folks think your idea is brilliant, and ignore anything that doesn’t fit your desired narrative. Eric Lasker puts it in brasher terms: “I’m a big believer in finding your hypothesis and trying to burn it down as quickly as possible — do as much as you can to destroy any ego you have about your product and your ability to make a sale. The goal in the early days should be to really test if you have something the market wants, almost more than your ability to sell it.”

Don’t skirt around things that aren’t exactly what you want to hear — embrace them. “People don’t like to upset you, they’re going to want to tell you what you want to hear. But the best salespeople (and the best founders) are not afraid to ask the potentially uncomfortable questions early on,” Sam Taylor told me.

Tactic 4: Leave the sales books on the bookshelf

As you gear up to take on this work, there may be a stack of sales books on your nightstand or sitting in your Amazon cart. Don’t bother cracking them open (or at the very least, don’t set your expectations too high), says Eric Lasker.

I’ve not seen great success with people trying to learn sales without doing it — the best salespeople learn from an apprenticeship structure. You have to get knocked around a bit to really internalize how this all works.

-Eric Lasker, Chief Revenue Officer of Varda Space

Mike Molinet strongly gives this a plus-one. “I got away from taking calls a bit when building Branch — I really only did external meetings when I had to. Now I’m spending a lot of time building relationships and meeting people, even if there’s no immediate opportunity to sell. Because you never know if two jobs from now that person will land in a place where they need a solution like Thena,” he says.

Just how much is he investing in this relationships-driven approach? He’s got the numbers to show for it. “I did over 1,100 external calls last year — that’s between prospects, customers, and general networking and relationship building. That’s over 20 calls a week,” Molinet told me.

There are thousands of sales books on Amazon. But doing 20 calls a week for three months will teach you more about selling than any of those books ever could.

-Mike Molinet, co-founder of Thena and Branch

Tactic 5: Get some grown-up process

Process may seem like an unnecessary layer of drudgery early on. Each deal that you manage to get over the finish line feels quite bespoke (and, let’s face it, a bit of a miracle). Most founders swing between two extremes: totally winging it or prematurely building a complex sales machine.

Here's what I've learned: While you don't need to go overboard with process early on, you'd be shocked at how much a light layer of rigor can grease the wheels. Distraction level for founders can be high, and folks often falter at the simple blocking and tackling of follow-up. Especially as you move from pure discovery to trying to get a prospect to commit to a budget item, that requires a ton of rigor.

Clarity = repeatability

“In the founder-led sales era, I admittedly ran a pretty messy sales process. I was moving so quickly that process was not top of mind,” Alexa Grabell told me. “I always followed my gut instead of following a tailored flow of doing discovery, then getting this person in a room, then bringing in the technical evaluation, then doing a proper demo, then having a conversation around contract or negotiation. But after we hired an extremely process-oriented seller, I saw how much prospects appreciated clear instructions.”

Two years ago I would say a tailored step-by-step process was overkill for founder-led sales. But the more prescriptive we got with our process, the more deals we closed.

-Alexa Grabell, founder & CEO of Pocus

Eric Lasker reiterated to me that it’s never too early to start aiming for sales repeatability. “You don’t need to over-engineer it, if there’s a pattern that just seems to keep coming up — if you’ve got five deals in the pipeline and four of them hit a sequence of stages, you should probably write that down,” he says.

Don’t be overly dogmatic about it, but start developing a hypothesis about your funnel stages, you can always change them later as you learn more.

-Eric Lasker, Chief Revenue Officer of Varda Space

Before starting Pomelo Care, Marta Bralic Kerns had spent seven years at Flatiron Health, where she learned a ton about the standard sales process for healthtech. But even with that playbook in her back pocket, she explained to me that there was tons of trial and error along the way. “We had to learn what our sales process would be. We didn’t know who the first meeting should be with, the second meeting, what written documentation we should send after that (a proposal on slides, a one-pager, a written proposal?)” she says.

As you come up with your own light sales process, here are some questions she suggests to help guide you:

- Who should be in each meeting?

- How many meetings should we have?

- What are the next steps after each meeting?

- What format are we putting the contract in?

- What are the terms we’re negotiating?

- What are we saying yes and no to?

Tactic 6: Think advisors, not hires

While you might be a team of just one or two in the founder-led sales days, that doesn’t mean you need to forge ahead solo into the unknown, whacking away at the brush.

Across every step of founder-led sales — from the very first call with a prospect to writing up an enterprise contract, lean on advisors (and if you don’t have any yet, find some — your investors are a great place to start). The truth is, most founders try to hire a full-time sales leader way too early (and that’s a topic we plan to cover later on in this series). What you actually need in those early days is a brain trust of people who've done this before — they can help you catch leaks in your funnel without the pressure of adding permanent headcount before you have real repeatability and product-market fit.

“I had constant communication with sales advisors to walk me through best practices on everything from running great discovery, demos, negotiations,” Alexa Grabell told me (along with giving a shoutout to Emery Rosansky, who she says helped her power through every single early deal). “Find your sounding board.”

Wrapping Up: Put in your reps before hiring any sales reps

When I meet with founders, it’s usually quite clear who’s done the legwork here, even early on when the product is still in beta. One of the most powerful things about the early days of founder-led sales — if you approach it right — is that you're building up this incredible muscle memory and pattern recognition that will serve you for years to come. You're learning how your customers think, what actually motivates them to buy, and what it takes to get a deal across the finish line. No sales hire, no matter how experienced, can replicate that foundational knowledge.

So next time you feel that knot in your stomach about jumping into sales conversations, remember: You've got this. You've already sold plenty of people on your vision — your co-founder, your early employees, your investors. Now it's just about taking that native talent and adding some structure and intentionality around it. Simply put: there’s no replacement for putting in the reps.

Be sure to follow along with this series — we'll be diving deep into topics like how to find your ICP, the right approach to design partnerships, developing a pricing strategy that can go the distance, and much more. (You can catch future pieces by subscribing to The Review or following me on X @BigMekaStyle).